Market Outlook

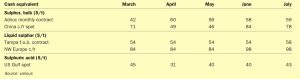

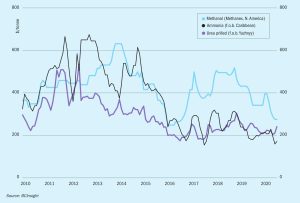

Ammonia prices have been on a rising trend over the past few months as plant closures begin to make themselves felt. Yara’s Baltic ammonia price also rose sharply at the start of October, and Nutrien’s announcement of the closure of its PCS-03 plant on Trinidad helped lift prices, with Yara and Mosaic’s contract prices rising $16/t in October.