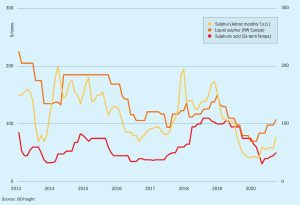

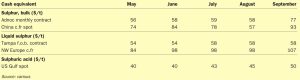

Market Outlook

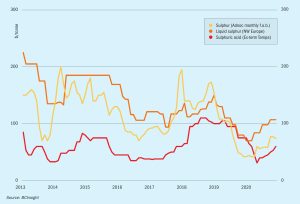

The global pandemic and new wave of lockdowns in some regions continue to pose a level of uncertainty to oil demand and in turn sulphur recovery. There are positive signs in the macro economic picture on the back of the vaccine rollout but significant question marks remain.