The merchant ammonia market

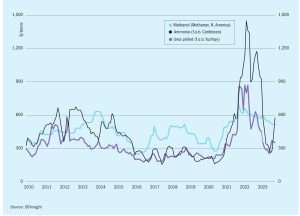

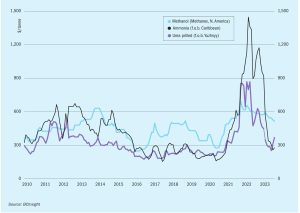

Merchant markets for ammonia have faced considerable disruption in recent years due to the covid pandemic and the war in Ukraine.

Merchant markets for ammonia have faced considerable disruption in recent years due to the covid pandemic and the war in Ukraine.

Tampa ammonia contract prices increased dramatically during September, from $395/tonne c.fr to $575/ tonne c.fr. The main culprit was plant outages and reduced production at several plants in the region. The tight supply situation was exacerbated by a delay to the restart of Ma’aden’s 1.1 million t/a ammonia plant in Saudi Arabia.

Proman has signed a memorandum of understanding (MoU) with Mitsubishi Corp to collaborate on the development of a blue ammonia plant at Lake Charles, Louisiana. This new facility will aim to produce around 1.2 million t/a of low carbon ammonia, making it one of the largest of its kind in the world. The plant will incorporate carbon capture and sequestration technology. Proman says that this development aligns with the company’s commitment to sustainability and reducing greenhouse gas emissions. The proposed ammonia plant will be located at Proman’s existing site in Lake Charles, adjacent to its gas-to-methanol plant, which is also currently being developed.

While the world’s attention has been grabbed by the terrible situation in the Middle East, the Russian-Ukrainian conflict continues to drag on. Of particular concern in recent months has been the deal to allow export of grain from Odessa, which lapsed in July 2023, a year after it first began. The deal had allowed 33 million tonnes of grain to be exported, around 60% of it to the developing world. However, Russia had always insisted that continuing with the deal was contingent on (a) a resumption of Russian ammonia exports via Odessa and (b) removing SWIFT payment restrictions on the Rosselkhozbank agricultural bank, allowing easier export of fertilizer. Fertilizers remain exempt from sanctions on Russia, but the difficulty in securing payment, the closure of the ammonia pipeline to the Black Sea, and high maritime insurance rates for traversing the Black Sea have made exports much more difficult. And although Ukraine continues to export grain, now mostly via rail to ports like Ismail and Reni on the River Danube, Russia has done its best to disrupt this, striking ports and warehouses and laying mines in shipping lanes. Around 300,000 tonnes of grain has been destroyed, according to Ukraine, as well as up to three ships hit by mines and one possibly by a missile on November 8th. Furthermore, bottlenecks in rail transit and port capacity and the difficulty in getting ships to the ports mean that actual volumes of grain exported are considerably reduced, with only around 700,000 tonnes exported via the Danube Ports from August to the start of November.

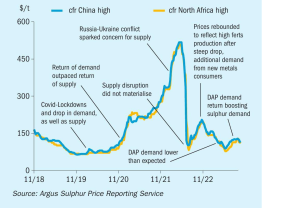

Volatility in sulphur prices has been reduced in the past year following the large price spike and subsequent drop in the summer of 2022. This price volatility has been due to various disrupted seasonal trends from the global pandemic, uneven recovery, geopolitical shifts and demand destruction for fertilizers.

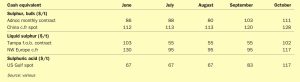

Market Intelligence Price Indications Table 1: Recent sulphur prices, major markets

The merchant market for sulphuric acid is only a small slice of overall global acid demand, dominated by smelter acid producers. Increasing replacement of acid imports by dedicated sulphur burning acid plants by end use consumers is reducing the scope for merchant sales and could lead to overcapacity in the near term.

A softer trend in DAP prices, linked to lower operating rates in China and declining demand, is contributing to falling sulphur prices.

Market Insight courtesy of Argus Media

Ammonia prices have now dropped by about 50% from their highs a year ago. Gas prices have fallen, particularly in Europe, and peak fertilizer application season is over in Europe and North America, leading to slackening demand., leading to slackening demand.