Russia mulls potash export quotas

Russia is considering limiting potash exports from the second quarter of 2025.

Russia is considering limiting potash exports from the second quarter of 2025.

Click here to access the February 2025 FI sentiment survey results.

CRU recently relaunched its Fertilizer International and BCInsight Platform. This relaunch coincided with the Fertilizer Latino Americano (FLA) conference in Rio de Janeiro, where we issued our inaugural sentiment survey for delegates. This insight presents and analyses the survey results, which point towards an optimistic tone for 2025 markets in Brazil and beyond. Prices are […]

Chile’s environmental regulator SMA has filed a charge against state-owned Codelco, alleging emission violations at its Potrerillos copper smelter in the Atacama region of northern Chile. An audit showed the company had not implemented a monitoring system for sulphur dioxide emissions and other procedures in accordance with environmental standards for the plant, Reuters news agency reported. The SMA labelled the charge as serious, which could lead to a fine of around $4.1 million, and possible revocation of the environmental permit or closure. Codelco had ten days to submit a compliance plan, and 15 days to present a defence.

Van Iperen International is pursuing an ambitious sustainability strategy to cut its carbon footprint by 50%.

As a tumultuous 2024 draws to a close, CRU’s fertilizer team to make a few predictions for the year ahead.

Dr Karl Wyant of Nutrien outlines how the phosphorus and potassium removed during soybean/corn rotations are best replenished.

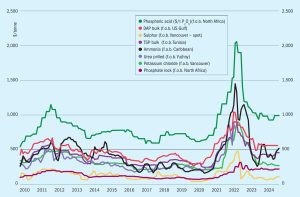

Market snapshot, 2nd January 2025

CRU’s 2025 Phosphates Conference – now in its 16th year – will be held in Orlando, Florida, 31 March - 2 April next year. The 2024 event convened in Warsaw was one of the most successful to date (Fertilizer International 519, p4).

Market snapshot, 17th October 2024 Urea : Prices firmed in a thin market in mid-October. Middle East values shot up $20/t on expectations that Indian Potash Limited (IPL) would announce another tender to secure tonnes for India in December. If correct, this will follow hot on the heels of the latest Rashtriya Chemicals and Fertilizers (RCF) purchase tender for 0.56 million tonnes of urea. Sohar International Urea & Chemical Industries (SIUCI) sold a November cargo at $390/t f.o.b. with further trader interest reported at $385/t f.o.b. This demand was probably generated by traders positioning themselves for IPL’s expected tender, given that other markets generally remained quiet.