India’s sulphur and sulphuric acid industries

India’s phosphate production is using increasing volumes of sulphuric acid, but new domestic smelter and sulphur burning acid capacity may mean reduced imports in future.

India’s phosphate production is using increasing volumes of sulphuric acid, but new domestic smelter and sulphur burning acid capacity may mean reduced imports in future.

China’s acid production continues to grow as new smelters come on-stream. But high domestic demand from phosphate production as export restrictions are lifted and a shortage of copper concentrate may limit the potential for acid exports.

Muntajat announced its QSP for September at $125/t f.o.b., an increase of $19/t from its August price. This was following its tender earlier this week, which market sources indicated to have achieved at or around $130s/t f.o.b. Over the past two weeks, KPC in Kuwait closed two sales tenders, with both indicated awarded in the high $120s/t f.o.b. Middle East spot f.o.b. prices are at their highest level since March 2023 and have climbed 58% over the past two months.

This year will be the 40th Sulphur – now Sulphur + Sulphuric Acid – Conference to be held. From its beginnings in Canada to this year’s meeting at the Hyatt Regency hotel in Barcelona, much has changed, but its mission – to be an essential annual forum for the global sulphur and acid community – remains the same.

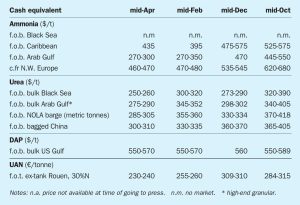

Ammonia benchmarks west of Suez remain supported by limited availability at key regional export hubs amid increased potential for cargoes to arrive from the East, where availability is far healthier, and prices appear under pressure. The disparity in prices was illustrated towards the end of August, when Nutrien sold 25,000 tonnes to multiple buyers in NW Europe for 1H September delivery at $550-555/t c.fr. When netted back to Trinidad, the price marks a sizeable premium on the $375/t f.o.b. last achieved by Nutrien back in late June, although given that last business in Algeria was fixed at $520/t f.o.b., it appears there is room for delivered sales into Europe to move up further. Regional availability is still limited, with extreme weather conditions in the US Gulf and North Africa potentially impacting supply further over the coming weeks.

The ammonia market reverted to recent norms at the end of April, with prices more or less unchanged in the east, and several benchmarks west of Suez moving downward in line with May’s Tampa settlement. Following a trio of high-priced c.fr spot deals many wondered whether such business would be replicated in Asia, but the hype did not live up to the expectation, with the majority of tonnes continuing to move on a contract basis into the likes of South Korea and Taiwan, China. The $430/t c.fr concluded into China has been attributed to both supply uncertainty and an uptick in domestic demand, though several inland prices declined this week, rendering price direction difficult.