Gas pricing and market reform

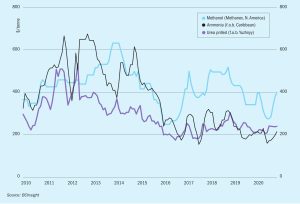

Natural gas pricing remains the dominant component of ammonia production costs. The fall in global oil and gas prices due to the Covid outbreak and the continued growth in the LNG market is continuing to break the hold of oil indexation on gas pricing. Meanwhile, reform of gas markets continues, in places as diverse as Brazil, China and India.