Constraints on renewable production

With low carbon ammonia and methanol being considered not just for their chemical and fertilizer uses, but as fuels, can we make enough of them to fill our energy needs?

With low carbon ammonia and methanol being considered not just for their chemical and fertilizer uses, but as fuels, can we make enough of them to fill our energy needs?

Low carbon production is attracting considerable attention to using syngas derivatives as fuels, but there are considerable logistical and commercial barriers to overcome.

SunGas Renewables Inc. has formed a new subsidiary, Beaver Lake Renewable Energy, LLC (BLRE), to construct a new green methanol production facility in central Louisiana. The project will have a capacity of 400,000 t/a of green methanol, using gasified biomass, specifically wood fibre from local, sustainably-managed forests as feedstock. The methanol will have a negative carbon intensity through sequestration of the nearly 1.0 million t/a of carbon dioxide produced by the project, which will be executed by Denbury Carbon Solutions. The methanol will then be used as a clean marine fuel by A.P. Moller–Maersk, which is building a fleet of methanol-powered container vessels.

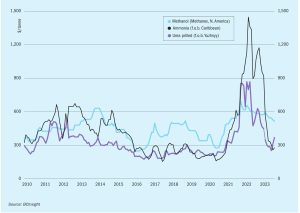

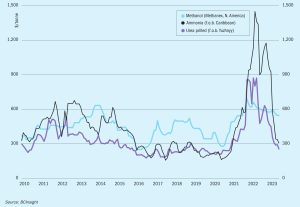

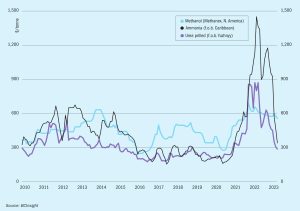

Ammonia prices have now dropped by about 50% from their highs a year ago. Gas prices have fallen, particularly in Europe, and peak fertilizer application season is over in Europe and North America, leading to slackening demand., leading to slackening demand.

The International Methanol Technology Operators Forum (IMTOF) met at the Leonardo Royal St Paul’s hotel in London from June 11th-14th.

While demand for ammonia remains – for now at least – strongly tied to fertilizer and farming, over the three decades that I’ve edited this publication, methanol’s story has been a very different one, with a succession of major new slices of demand coming every few years from new applications that flare up and then mature or even drop away again. For a while in the 1990s it was MTBE, the oxygenated fuel additive that had a brief flourish in the US before being shut down by leaking fuel tanks leaching into ground water. Then there was dimethyl ether (DME) as a blendstock for LPG, and methanol itself directly blended into gasoline in China to keep up with soaring vehicle fuel demand. More recently, methanol to olefins (MTO) has added almost another 25% of demand over and above existing chemical and fuel uses. But as the world cracks down on coal production and use, China’s attempt to use methanol as a way of using domestic coal to replace imported oil seems to have passed its high water mark and begun to recede.

A round-up of current and proposed projects involving non-nitrogen synthesis gas derivatives, including methanol, hydrogen, synthetic/substitute natural gas (SNG) and gas- and coal-toliquids (GTL/CTL) plants.

Supply in southeast Asia looks tight for the coming weeks, but further declines in Chinese domestic prices could alter the supply/demand balance in the region in August.

Johnson Matthey (JM) has signed an LCH™ technology licence with Equinor and Linde Engineering for H2H Saltend, one of the UK’s largest low carbon hydrogen projects. JM was selected alongside EPC partner Linde Engineering for the major FEED contract by Equinor. The licence counts towards JM’s milestone of winning more than ten additional large-scale projects by 2023/24.

Further downward corrections are possible but the rate of demand is stabilising, suggesting the market floor is in sight, though some have suggested that May could bring another sharp reduction in the Tampa contract price towards the mid$300s c.fr. Demand remains sluggish in both eastern and western hemispheres.