Nuclear powered ammonia

With green ammonia from renewable energy facing cost hurdles to adoption, thoughts have turned to using nuclear energy as a carbon free alternative.

With green ammonia from renewable energy facing cost hurdles to adoption, thoughts have turned to using nuclear energy as a carbon free alternative.

OCI Global says that it has reached an agreement for the sale of 100% of its equity interests in its Clean Ammonia project currently under construction in Beaumont, Texas for $2.35 billion on a cash and debt free basis. The buyer is Australian LNG and energy company Woodside Energy Group Ltd. Woodside will pay 80% of the purchase price to OCI at closing of the transaction, with the balance payable at project completion, according to agreed terms and conditions. OCI will continue to manage the construction, commissioning and startup of the facility and will continue to direct the contractors until the project is fully staffed and operational, at which point it will hand it over to Woodside. The transaction is expected to close in H2 2024, subject to shareholder approval.

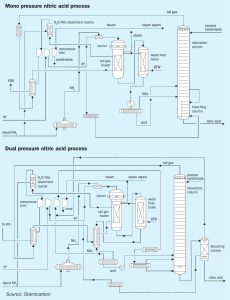

Stefano Cicchinelli and Carmen Perez of Stamicarbon (MAIRE) explore the latest advancements in tertiary abatement technologies, their implementation in nitric acid plants, and the implications for the fertilizer industry.

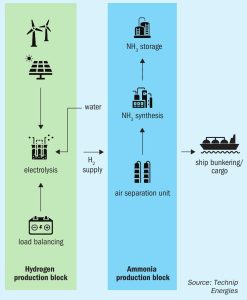

Green ammonia production facilities can be situated in remote areas with access to often fully off-grid renewable power supply. This article examines plant concepts and discusses the challenges and solutions for these plant architectures. Through a case study, an efficient and innovative methodology to compare options and optimise the sizing of the plant is presented. The methodology addresses the intermittency of the power production, the flexibility limits of the main process units, and the costs of investment and operation, using proprietary techno-economic dynamic simulation software, Odyssey.

In its most recent interim report, published on August 15, renewable energy developer Ørsted said that it was abandoning the FlagshipONE renewable methanol project because the anticipated market for green methanol as a marine fuel had not materialised as quickly as expected. The strategic decision comes nearly two years after final investment decision (FID) on the project.

Shell Deutschland has taken a final investment decision (FID) to progress REFHYNE II, a 100 MW renewable proton-exchange membrane (PEM) hydrogen electrolyser at the Shell Energy and Chemicals Park Rheinland in Germany. Using renewable electricity, REFHYNE II is expected to produce up to 44 t/d of renewable hydrogen to partially decarbonise site operations. The electrolyser is scheduled to begin operating in 2027. Renewable hydrogen from REFHYNE II will be used at the Shell Energy and Chemicals Park to produce energy products such as transport fuels with a lower carbon intensity. Using renewable hydrogen at Shell Rheinland will help to further reduce Scope 1 and 2 emissions at the facility. In the longer term, renewable hydrogen from REFHYNE II could be directly supplied to help lower industrial emissions in the region as customer demand evolves.

Join us at the CRU Sulphur + Sulphuric Acid 2024 Conference and Exhibition in Barcelona, 4-6 November, for a global gathering of the sulphur and sulphuric acid community. Meet leading market and technology experts and producers, network, share knowledge, and learn about market trends and the latest developments in operations, process technology and equipment.

Veolia says that its subsidiary Veolia North America has signed an agreement for the divestment of Veolia North America Regeneration Services, which includes its sulphuric acid and hydrofluoric acid regeneration activities for refineries, to private equity firm American Industrial Partners for $620 million. These activities represented revenues of around $350 million in 2023. The financial closure of the transaction is expected soon. Veolia’s Sulphuric Acid Regeneration Business includes its sulphuric acid and potassium hydroxide regeneration, as well as sulphur gas recovery, and sulphur-based products production businesses.

Saudi Aramco has sold another tranche of 1.54 billion shares, amounting to 0.64% of the company’s total ownership. The sale, at 27-29 riyals per share, was oversubscribed by a factor of five, making it more popular than the previous IPO, in 2019, which sold 1.5% of the company’s shares for a total of $29.4 billion. Foreign take up of shares was also higher this time, with more than half of sales to foreign investors, compared to 23% for the 2019 sale. However, it remains relatively small in scale compared to Saudi Arabia’s ambitions as part of its Vision 2030 plan to encourage more foreign direct investment and wean the country off its dependence on oil. Aramco is the world’s largest oil company in terms of both daily crude production and market cap, and remains 82% in the hands of the government and 16% held via the country’s sovereign wealth fund, the Public Investment Fund (PIF).

With all of the focus on low carbon ammonia and methanol developments, one could occasionally be forgiven for forgetting that most of the syngas industry relies upon natural gas as a feedstock, and that gas pricing and availability remain the key determinants of profitability for producers. As our article this issue discusses, even low carbon ammonia is likely to be largely based on natural gas, albeit with carbon capture and storage, at least for the remainder of this decade.