Clean ammonia projects and technologies

New methods for low-carbon ammonia production are emerging, while project activity is also rising rapidly.

New methods for low-carbon ammonia production are emerging, while project activity is also rising rapidly.

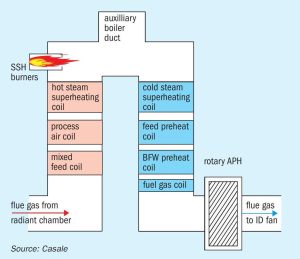

When revamping the steam methane reformer, a detailed analysis of the whole reformer by an experienced technology licensor with deep plant knowledge is required to achieve the best solutions. Casale presents two case studies which provide examples of what can be achieved when following this approach.

CRU’s Nitrogen + Syngas conference convened at the Hyatt Regency Barcelona Tower in Barcelona, from March 5th-8th.

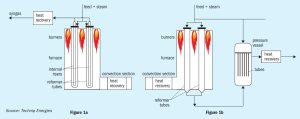

Previously, recuperative reforming has been mostly applied for capacity increase revamps, but nowadays it is a key enabler for efficient low carbon hydrogen and syngas production. Jan-Jaap Riegman of Technip Energies, Francesco Baratto of Casale and Stefan Gebert of Clariant discuss the benefits of recuperative reforming for reducing the carbon footprint of existing assets.

Blended and compound NPK fertilizers are a mainstay of many markets globally. We review the main production technology options.

Advanced Methanol Amsterdam (AMA) is a production facility, that will be realised in the Port of Amsterdam's Biopark, which is destined to produce advanced methanol that meets the European renewable energy directive (RED) requirements. Once completed, AMA will be the flagship production site for GIDynamics and GIDARA Energy and for its High Temperature Winkler (HTW ® ) gasification technology. AMA will also be the first of its kind green methanol unit designed by Casale.

CRU Events will host the 2023 Nitrogen + Syngas conference and exhibition at the Hyatt Regency Barcelona Tower in Barcelona, 6-8 March.

Casale has developed a range of methanol-ammonia coproduction processes to match different requirements according to product capacity.

Venkat Pattabathula, a member of the AIChE Ammonia Safety Committee, reports on the American Institute of Chemical Engineers’ Safety in Ammonia Plants and Related Facilities Symposium, held at the Hyatt Regency in Chicago, USA, on 11-15 September 2022.

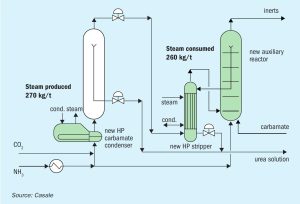

Casale reviews urea plant revamping process schemes and successful case studies for energy savings and TOYO discusses its latest revamping technologies including application of the new generation low-pressure, energy-saving ACES21-LP™ process.