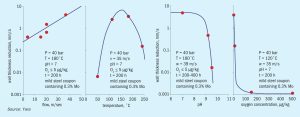

In recent years, extensive and severe internal attack has been observed of carbon steel equipment and lines in aqua ammonia service at several Yara manufacturing sites across the globe. In all cases, the damage has a distinct flow-accelerated corrosion (FAC) signature which challenges the current understanding of FAC. All features typically observed for this kind of damage mechanism, that seem to be specific to the NH3 recovery section of ammonia plant, are reported. Upgrading the material of construction for this unit, will solve this failure mode, but a leak would potentially generate health and safety problem for the release of ammonia.