Nitrogen + Syngas 2023

CRU Events will host the 2023 Nitrogen + Syngas conference and exhibition at the Hyatt Regency Barcelona Tower in Barcelona, 6-8 March.

CRU Events will host the 2023 Nitrogen + Syngas conference and exhibition at the Hyatt Regency Barcelona Tower in Barcelona, 6-8 March.

Cansu Doganay of Lux Research takes a look at the current technology landscape for methane pyrolysis for producing low-carbon hydrogen from natural gas.

A review of the current slate of plans for green and blue ammonia production.

Covid, demographics and a shift from an industrial to a consumer-led economy have stalled China’s previously breakneck growth, with a potential impact upon all commodity markets, including fertilizer. At the same time, Chinese export restrictions have overheated the urea market.

With Europe facing a long-term shortage of natural gas, and Russia looking east for new customers, how will changing global gas markets affect production of key syngas-based chemicals?

The International Fertilizer Development Centre (IFDC) has appointed Henk van Duijn as President and Chief Executive Officer (CEO) as of January 1st 2023. Van Duijn brings more than 30 years of experience in agriculture and international development, with a focus on Europe, Africa, and Asia. Prior to his selection as IFDC President and CEO, van Duijn served as Vice President, Corporate Services, and Chief Operations and Finance Officer at IFDC. Before that, he headed the 2SCALE program (2019-2021) and served as CEO of Bopinc (2014-2019). As a diplomat and civil service director in the Netherlands, van Duijn led the design, startup, and implementation of large-scale interdisciplinary programs as well as national and international public-private partnerships in Europe, Africa, and Asia. He holds a master’s degree in Land and Water Management from Wageningen University & Research.

The past year has been a difficult, even disastrous one for Europe’s fertilizer producers. High natural gas prices have kept plants shuttered, with 70% of the continent’s ammonia production shut down at times. It remains uncertain how much of this will return to production this year, or indeed ever.

Ammonia prices registered another week of losses at the start of January, with supply options continuing to outweigh demand in most regions. Prices have been falling steadily for the past twelve weeks, as the market rebalances after production curtailments across Europe for much of 2022. Steady falls in gas pricing over the past few weeks have put production costs firmly below today’s import price, with European production now scheduled to ramp up at many plants this month.

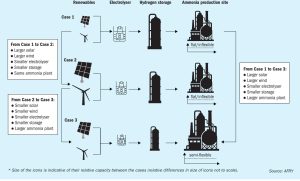

Due to the inherent nature of the renewable power, sizing eSyngas plants powered with renewable energy brings complexity normally not faced by natural gas-based facilities. In this article, Dr Raimon Marin and Dr Solomos Georgiou of AFRY discuss the application of AFRY’s state-of-the-art modelling tool to optimise the size and production of a green hydrogen system and a green ammonia plant based on given renewable power profiles and their associated variability (e.g., hourly, daily, seasonally, and annually).

Stamicarbon has won a contract for a large-scale urea project in China. The urea plant, with a production capacity of 3,800 t/d, will be the largest ever licensed by Stamicarbon in the country. The customer, the plant’s location and the value of the contract have not been disclosed.