Ammonia safety at sea

A look at the safety challenges that face developers of ammonia-powered shipping vessels before it can become used more widely as a low carbon fuel.

A look at the safety challenges that face developers of ammonia-powered shipping vessels before it can become used more widely as a low carbon fuel.

Casale, Saipem, Stamicarbon & Toyo Engineering Corporation showcase a selection of innovative technologies that have recently been brought to the market.

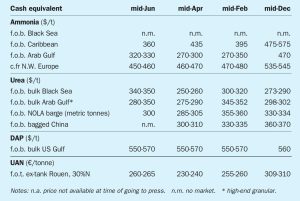

Ammonia markets were quiet in June, though both CF Industries and Grupa Azoty were reported to be looking for July tonnes and the enquiry will test how tight the market is going forward. Algeria has traded in the $400-405/t f.o.b. range, suggesting c.fr values in Europe might be slightly higher at $450-460/t c.fr. Supply from Algeria has been and continues to be somewhat restricted because of constraints caused by the hot weather. Gas supply however is easing in Egypt and further ammonia exports should emerge shortly.

Prices in the Eastern Hemisphere, whilst still flat-to-firm, do not appear as supported as they have been over the past month, whilst indexes. There are still no signs of softening in the Far East although demand remains underwhelming and supply improving. While production in Indonesia is said to be back up and running, traders do not expect any spot cargo to emerge in July other than possibly some small part cargoes. August could see spot offers.

Pres-Vac Engineering's innovative high-velocity methanol valves offers shipbuilders unique options in creating more efficient and compliant dual-fuel systems.

The reliability of primary reformers is a key issue for syngas plants. Quest Integrity describes the damage mechanisms and material limitations that impact the reliability of reformer outlet systems and the improvements that may be implemented.

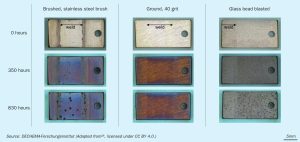

Industrial plants using synthesis gas at elevated temperatures risk metal dusting attack on the equipment, which are typically made of steels or Ni-based alloys. Parameters which impact the metal dusting risk are discussed and factors affecting the material selection and processing are described. One important focus is surface preparation, showing that grinding (40 grit) improves the metal dusting resistance compared to glass bead blasting and brushing. The surface treatment outweighs the impact of welds or the manufacturing route.

Hanwha Corporation and INEOS Nitriles have announced their intention to collaborate in a study for a new low-carbon ammonia facility with carbon sequestration in the USA, with a capacity of more than 1 million tonnes per annum. The location of the plant is yet to be determined. The two companies have agreed heads of terms, under which Hanwha and INEOS will jointly explore the feasibility of a facility to meet the growing global demand for ammonia with low-carbon emissions. A final investment decision is planned for 2026 with planned commercial operation in 2030.

A review of the current slate of plans for green and blue ammonia production.

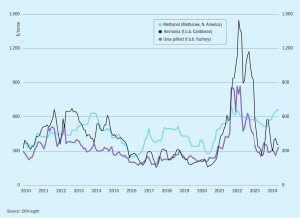

With all of the focus on low carbon ammonia and methanol developments, one could occasionally be forgiven for forgetting that most of the syngas industry relies upon natural gas as a feedstock, and that gas pricing and availability remain the key determinants of profitability for producers. As our article this issue discusses, even low carbon ammonia is likely to be largely based on natural gas, albeit with carbon capture and storage, at least for the remainder of this decade.