Syngas project listing 2021

A round-up of current and proposed projects involving non-nitrogen synthesis gas derivatives, including methanol, hydrogen, synthetic/substitute natural gas (SNG) and gas- and coal to liquids (GTL/CTL) plants.

A round-up of current and proposed projects involving non-nitrogen synthesis gas derivatives, including methanol, hydrogen, synthetic/substitute natural gas (SNG) and gas- and coal to liquids (GTL/CTL) plants.

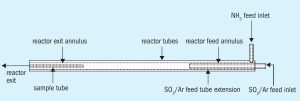

The internals of ammonia synthesis converters are generally made of austenitic stainless steel to withstand the harsh operating conditions (high temperature, high pressure and synthesis gas containing hydrogen and ammonia). Since nitriding is the most critical material degradation for the converter internals, Casale has set up a large nitriding analysis campaign. In the last decade, samples of materials operated under different pressures and temperatures and for different time spans have been tested and analysed. The data obtained has been used to increase nitriding knowledge and to establish a correlation to predict nitriding rate to allow the most suitable material and relevant thickness to be selected. L. Redaelli and G. Deodato of Casale report on how this correlation was established and provide valuable insight on this phenomenon and how to predict and control it.

Metal dusting corrosion damage on steam reformers is no longer a major issue in modern methane steam reformer units. Nevertheless, failures related to metal dusting corrosion attack still take place in some specific designs and configurations that are more prone to experience this damage. Poor maintenance or deterioration of insulation components on transition areas might expose metallic surfaces to metal dusting attack. In this article, Dr P. Cardín and P. Imízcoz of Schmidt+Clemens Group describe different case studies, where the end users benefited from the experience of a collaboration to address potential risks and improve plant reliability against metal dusting corrosion damage.

At a time when green (or maybe blue) ammonia is being looked to as a way of reducing carbon emissions, substituting for hydrocarbons in a variety of potential uses, a conference held at the start of June was a reminder that nitrogen, its neighbour on the Periodic Table, is by no means off the hook on the environmental front. The Eighth Global Nitrogen Conference – held over from last year because of Covid-19, and this year held virtually, as most events are for the time being – was the latest in a series of tri-annual meetings convened by the International Nitrogen Initiative (INI), with support from the UN Economic Commission for Europe (UNECE) and the German Ministry of the Environment. The INI grew out of the 1979 UNECE Convention on Long-range Transboundary Air Pollution and 1999 Gothenburg Protocol, and is concerned specifically with ‘reactive nitrogen’ (i.e. nitrogen not tightly bound to itself in a triple bond, which makes up 78% of the air around us).

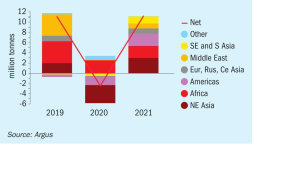

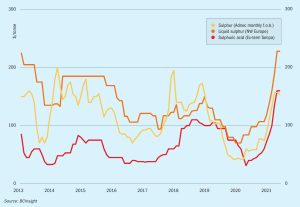

Meena Chauhan , Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

Commodity markets are often volatile, and sulphur and sulphuric acid can be more so than most, with much of their supply coming from involuntary production, and sulphur supply in particular often dependent on the timing of large scale oil and gas projects. Even so, this year’s price rises, in some cases tripling in just over a year, have been especially eye-catching.

Sulphur ’s annual listing of new or recently completed sulphur forming projects worldwide covers both new sour gas and refinery sulphur forming projects as well as upgrades at existing units.

Significant capacity additions in the Middle East are still awaited. The more positive outlook for fuel demand is providing support to seeing these projects ramp up in the coming months. New supply is expected from Saudi Arabia following the commissioning of a gas project in 2020, sulphur availability is likely to improve from the country through the second half of 2021 and into 2022 as a result.

Are the three “T”s (temperature, turbulence, time) of Claus unit ammonia destruction still meaningful with improved understanding of the thermal reactor? CFD models appear to be adequate at higher temperatures, e.g. 1,200°C, but not at lower temperatures, e.g. 800°C and 1,000°C. A. Keller, on behalf of the Amine Best Practices Group, reviews how meaningful the rules of thumb for Claus unit ammonia destruction really are.

What lessons can be learnt from the successful commissioning and start-up of major fertilizer industry construction projects? Recent case studies from the nitrogen, phosphate and potash industries provide some interesting answers.