Who’s who in fertilizer handling, bagging and blending

An update on the latest in fertilizer ship loading, handling, bagging and blending, including new contracts, company news and advances in technology.

An update on the latest in fertilizer ship loading, handling, bagging and blending, including new contracts, company news and advances in technology.

Anglo American is developing the Woodsmith project in northeast England. This will access the world’s largest known deposit of polyhalite, a natural mineral fertilizer containing potassium, sulphur, magnesium and calcium – four of the six nutrients that every plant needs to grow.

2021 is turning out to be a very good year for profits and earnings. Take Nutrien and Yara International, for example, the fertilizer sector’s two biggest companies by market capitalisation.

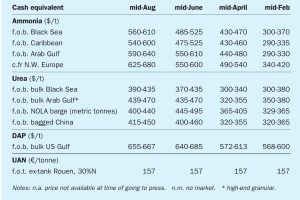

Market Insight courtesy of Argus Media

While the past couple of years have seen considerable excitement and momentum concerning the use of blue/green ammonia as a fuel, an announcement in August by Maersk, the largest shipping company in the world, has served once again as a useful reminder that ammonia is not the only candidate molecule. Maersk said on August 24th that it is ordering eight methanol powered vessels from South Korea’s Hyundai Heavy Industries at a total cost of $1.4 billion. Each giant ship will have the capacity to carry 16,000 twenty-foot [container] equivalent units (TEUs).

Market Insight courtesy of Argus Media

The ammonium nitrate explosion in Beirut in August 2020 has once again focused minds upon the potential risks associated with the chemical.

Venkat Pattabathula, a member of the AIChE Ammonia Safety Committee, reports on the American Institute of Chemical Engineers’ Safety in Ammonia Plants and Related Facilities Symposium, held virtually on 30 August to 2 September 2021.

The fact that biuret is toxic to plants has been known for a long time – since the middle of the last century. Very sensitive (pineapple, citrus), moderately sensitive (cereals, legumes) and resistant (conifers) plant species were identified. The maximum concentration of biuret in urea for each species has been established for soil application and foliar application. Most field crops easily tolerate foliar fertilization with urea, which contains 1 wt-% biuret. Potatoes and tomatoes are more sensitive – for foliar feeding of these crops, it is advisable to use urea with an admixture of biuret of no more than 0.5 wt-%. Citrus fruits and pineapples are so sensitive that biuret in urea for foliar feeding should be no more than 0.35 wt-%.

The first half of 2021 has been characterised by tight supply in the ammonia market, exacerbated by plant outages in Europe, Trinidad, Saudi Arabia and Indonesia. At the same time, higher spot demand has fuelled significant price increases in both the eastern and western hemispheres. Low inventories and reduced export availability in the Far East forced Indian phosphate producers and industrial consumers of ammonia to source product from other locations.