Sulphur World Symposium 2022

The Sulphur Institute’s (TSI’s) annual Sulphur World Symposium was held in Tampa, Florida this year, from May 9th-11th.

The Sulphur Institute’s (TSI’s) annual Sulphur World Symposium was held in Tampa, Florida this year, from May 9th-11th.

Acid output is expected to increase as copper mining and smelting increases; the copper market is moving moves from deficit to surplus, with copper output expected to rise 5% in 2022 as demand increases for electric vehicles.

Condensate formation in sulphuric acid plants can cause severe corrosion problems leading to high maintenance and plant downtime. Santhosh S . of Metso Outotec discusses the importance of carrying out regular monitoring and maintaining accurate and detailed data about condensate to increase equipment life and avoid downtime. Different sources of condensate formation in the plant are discussed as well as the typical locations in the plant where the condensates end up.

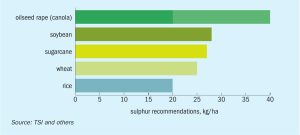

Sulphur is becoming an increasingly vital crop nutrient, due to a combination of lower sulphur deposition from the atmosphere, the increasing prevalence of high-analysis fertilizers and higher cropping intensity.

Copper leaching and smelting projects in Zambia and Zimbabwe continue to dominate acid production and consumption, with output expected to increase from the Kamoa-Kakula project.

We compare and contrast the 2021 financial performance of selected major fertilizer producers following the publication of fourth quarter results.

Market Insight courtesy of Argus Media

The war in Ukraine has caused 9,000 civilian deaths and created 5.7 million refugees. If this immense and spiralling human tragedy was not enough, the unprecedented shock inflicted on commodity markets continues to unfold.

More than 300 delegates from over 130 companies and 29 countries gathered for CRU’s Phosphates 2022 conference, 7-9 March.

More than 745 delegates from 335 companies and 50 countries gathered at the Hilton Downtown, Miami, Florida, 21-23 March, for the Fertilizer Latino Americano 2022 conference. The event was jointly convened by Argus and CRU.