The year ahead – affordability vital

We look ahead at fertilizer industry prospects for the next 12 months, including the key economic and agricultural drivers likely to shape the market during 2023.

We look ahead at fertilizer industry prospects for the next 12 months, including the key economic and agricultural drivers likely to shape the market during 2023.

Fertilizers are always political to some extent, sitting as they do at the intersection of key commodities such as oil and gas on the one hand and food on the other. Markets for major nitrogen derivatives have often been distorted by political decisions to achieve self-sufficiency in fertilizer production, such as in, e.g. China or India. But over the past couple of months ammonia has found itself particularly in the political spotlight, in the context of the ongoing conflict in Ukraine, which continues to shape and indeed re-shape global commodity markets.

Market Insight courtesy of Argus Media

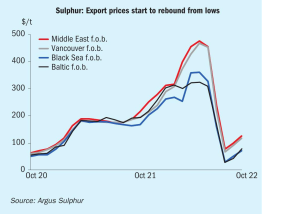

Sulphur markets suffered a correction in July-August that was more of a collapse; from $500/t to less than $100/t. Though it seems to have been something of an over-correction, and prices have moved back up since then, it is one of the most extreme price swings that sulphur has ever seen, comparable to the peak and precipitous fall in 2008. Indeed, at a time when commodity prices of all kinds have seen extremely high levels of volatility, sulphur has been more volatile still than just about all of them.

Global demand for rare earth metals is increasing, particularly for electric vehicle batteries and renewable energy devices, potentially leading to increased use of sulphuric acid in their extraction.

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

A move towards so-called ‘sustainable aviation fuels’ (SAF) could see refineries having to recast their operations. What might this mean for sulphur production?

At the organisation’s first face to face meeting since covid, in Vienna in early October, OPEC+ ministers agreed to cut global oil supplies by 2 million bbl/d in November. OPEC+ is a group of 24 oil-producing nations, made up of the 14 members of the Organisation of Petroleum Exporting Countries (OPEC), and 10 other non-OPEC members, including Russia. In a statement, the group said the decision to cut production was made “in light of the uncertainty that surrounds the global economic and oil market outlooks.”

Sulphur is a relatively safe and inert solid. However, it has a number of unique physical and chemical properties which can give rise to hazards, particularly during transport and handling.

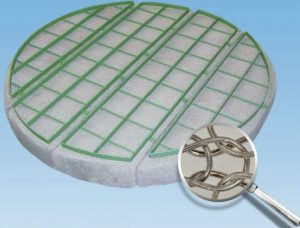

Daniel R. Egger of Sulzer Chemtech Ltd discusses mist elimination challenges in strong sulphuric acid applications and presents the unique Sulzer KnitMesh XCOAT™ mist eliminator as an ideal solution for corrosive services such as in sulphuric acid drying towers.