Sulphur 421 Nov-Dec 2025

21 November 2025

Pyrite-based acid production

PYRITES

Pyrite-based acid production

While sulphuric acid production is dominated by sulphur burning or metallurgical acid routes, pyrite roasting remains a niche sector, particularly in China.

Iron pyrite(FeS2) has a long history as a feedstock for producing sulphuric acid, but today it occupies a niche position in a market dominated by other sulphur sources. Roasting pyrites produces sulphur dioxide (SO2 ), which can be converted to sulphur trioxide (SO3 ) in the Contact process and then turned into sulphuric acid (commonly via the oleum route). Technically the route is straightforward, but economic and environmental realities have reshaped where and when it is used.

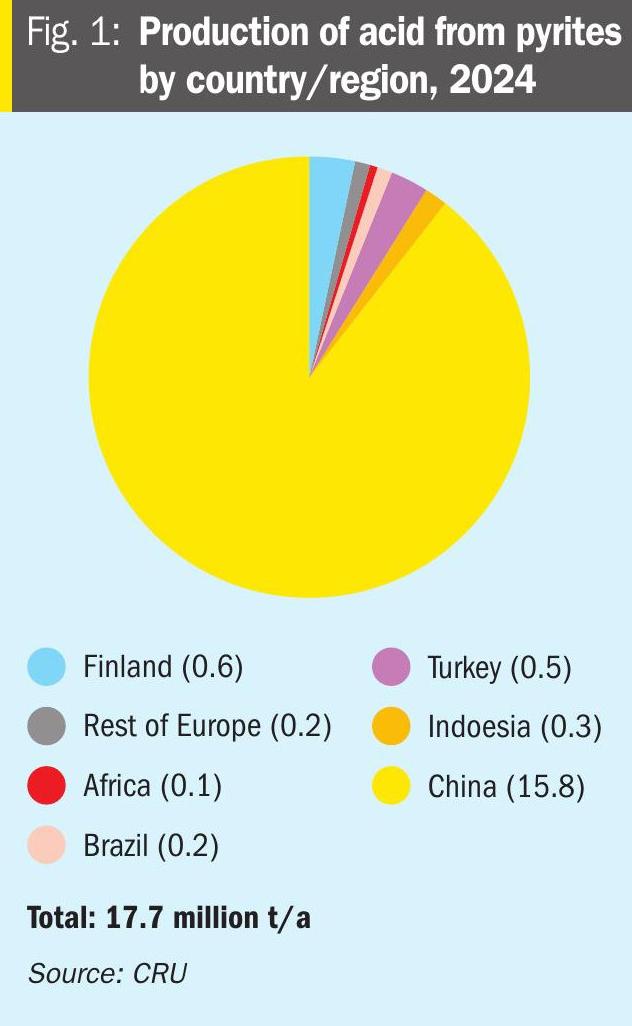

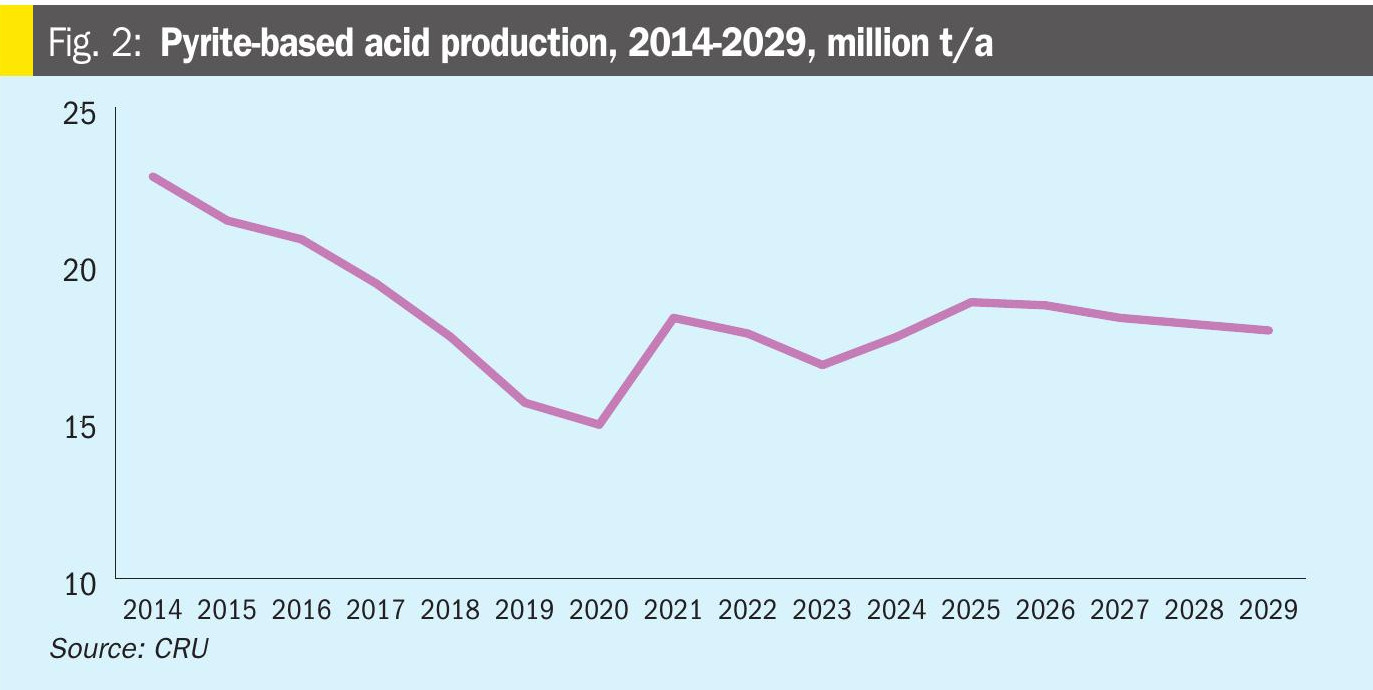

Global sulphuric acid production from pyrites reached a peak at around 30 million t/a in the 1970s, at which time it represented 22% of sulphur production in all forms. However, it has been in long-term decline since then, and was down to only 6% of total sulphuric acid production in 2024. Production of pyrite-based acid has gradually stopped in most of the world. It ended in the United States in 1988, Brazil and Bulgaria in the 1990s, India in 2003, Russia in 2007, and Zimbabwe in 2008 with the closure of the Iron Duke mine. Finland’s main pyrite mine is no longer operational and acid production is due to end soon. Nevertheless, some production continues in Brazil, Turkey, and particularly China (see Fig. 1), which now represents 89% of world pyrite roasting acid production, and there is also new production in Indonesia.

Process economics

The recovery of large volumes of sulphur from oil and gas as a by-product and the recovery of sulphur-rich off-gases from copper and other base metal smelting have collectively largely undercut the economics of pyrite mining for acid production, hence its gradual discontinuing in many of the countries that formerly used it, as noted above. Pyrite rock tends to be cheaper than elemental sulphur as a raw material, and the operating costs for a pyrite-based acid plant can be lower or comparable, but the lower capital cost of a sulphur burning acid plant makes for faster payback in the medium term. Some pyrite plants can be more profitable in the long term, but this depends on the price of sulphur, the ore grade, local availability, transport costs, and the cost of gas cleaning and waste handling.

The solid iron cinder produced in the process contains around 30-60% iron. The production of 1 tonne of sulphuric acid usually results in the creation of 0.8–1.5 tonnes of iron cinder. The cinder is not very valuable, and sometimes is merely disposed of as tailings, but it can be used in the manufacture of cement or as ballast in road construction, and it can also be used as a source of iron in steel manufacture, which has had particular application in China. China makes around 55% of the world’s steel, and the country imports large quantities of iron ore in order to do so. The iron calcine from pyrite manufacture can be used in lower grade steel manufacture and helps offset the process economics via an iron credit. In addition, there are also often trace ‘impurities’ such as copper and gold in the calcine, and recovery of these minerals can also assist with the economics of the process.

However, there are also considerable problems with pyrite roasting. Pyrites commonly contain arsenic, selenium and other trace metals. These can complicate gas cleaning, and even poison catalysts such as vanadium oxide, commonly used for sulphuric acid production. This makes feeds from elemental sulphur combustion or smelter offgases cleaner, easier to treat, and cheaper to process at scale. Roasting also generates particulate matter and acid gases; poor control risks air pollution and acid deposition. Exposed tailings can also lead to acid mine drainage, a persistent environmental problem. Robust offgas cleaning, tailings management, and catalyst protection increase capital and operating costs relative to cleaner sulphur feeds.

In general, pyrite roasting tends to make economic sense at mines with abundant low-value sulphide material where roasting is already part of ore processing and capturing SO2 adds value, and/or locations with restricted access to cheaper sulphur sources where local acid demand and regulatory frameworks make onsite production attractive. Integrated metallurgical plants that roast multiple sulphide minerals and can centralise gas treatment and acid production can also make pyrite roasting an attractive option.

Acid production

After its long slow decline from its peak in the 1970s, global pyrite production has actually been at a fairly stable level over the past two decades. In 2024 it accounted for just under 18 million t/a of acid production worldwide (see Fig. 2). While production in several countries has been declining or ceasing, Chinese production was actually on an upward trend in 1990s and 2000s, with many of the smaller producers – there were over 350 producers of pyrite based acid in 2006 – closing at the same time that larger, more efficient and lower cost plants were completed. In 2006, Outotec completed the world’s largest pyrites roaster at Tongling Nonferrous Metals, which produces 400,000 t/a of sulphuric acid, and Hunan Hengyang started up a 300,000 t/a acid plant based on pyrites in 2008. Some pyrite roasters have converted their acid plants to sulphur burning, though the sulphur price spike of 2008 and continuing strong demand for both sulphuric acid and iron, continue to make pyrites roasting economical in parts of China. Much of China’s sulphuric acid output is concentrated in Hubei and Yunnan provinces, with significant production also in Guizhou, Sichuan, Shandong and Anhui.

There have been predictions of the demise of China’s pyrite roasting acid industry for many years now, but the industry was kept alive via demand for iron and the burgeoning phosphate industry in China, which required ever-increasing amounts of sulphuric acid. In spite of increased competition from smelter-based acid production, a number of pyrite roasting plants continue to operate, and while some closures are forecast over the next few years, China will likely continue to maintain its pyrite roasting acid sector.

Rest of the world

Outside of China, the next largest producer of acid from pyrites in 2024 was Finland. Finland’s pyrites have mainly come from First Quantum Minerals (FQM) Pyhasalmi mine, the deepest in Europe at 1.45 km, which produces the bulk of Finland’s pyrites. However, underground mining at the site ended in 2022, and since then FQM has been processing pyrite-rich mine tailings to produce 330-350,000 t/a of pyrite for acid production. The tailings are expected to be exhausted late this year or early next, at which time FQM says that the mine will be closed “in accordance with best practice”. Turkey is also a significant producer of pyrites, consuming some domestically, as well as exporting to Uzbekistan and other countries.

However, the largest new source of pyrite-based acid is Indonesia. Merkeda Battery Materials (MBMA) started operations at a new pyrite plant in 2024. Pyrite is a by-product generated by copper mining at the company’s Wetar mine, and efforts to add value to the pyrite have been part of the company’s plans since 2019. The smelting process at the Wetar mine previously only yielded copper, leaving by-products that could not be further processed. The new AIM (Acid Iron Metals) plant is designed to process pyrite ore at a nominal rate of 1.0 million t/a, and consists of four interconnected processing facilities. The second phase, comprising the sulphuric acid plant, started production in April 2024. Both trains of the roaster/ acid plant are now in operation, with post-commissioning debottleneck modifications conducted. This year the plant is expected to generate about 1 million t/a of sulphuric acid, moving Indonesia into second place in pyrite acid production.