Fertilizer International 529 Nov-Dec 2025

20 November 2025

China looks beyond its potash heartland to secure supply

CHINA POTASH REPORT

China looks beyond its potash heartland to secure supply

China’s potash hub in western Qinghai and eastern Xinjiang is on the wane. Potassium chloride (MOP) output from these regions fell to an 11-year low in 2024. With permanent plant closures and resource depletion pressuring supply, China’s reliance on imported MOP and exposure to global pricing is set to rise. In this CRU Insight, Alexander Chreky reports on China’s potash industry in person – and reveals how the country’s investment in potash capacity internationally is also accelerating.

Introduction

In July 2025, I had an extraordinary opportunity to represent CRU and visit China’s impressive yet remote and inaccessible potash brine operations in western Qinghai province. The journey there was tortuous and lengthy, starting with plane and rail travel and culminating with endless hours driving across the dusty Qaidam basin.

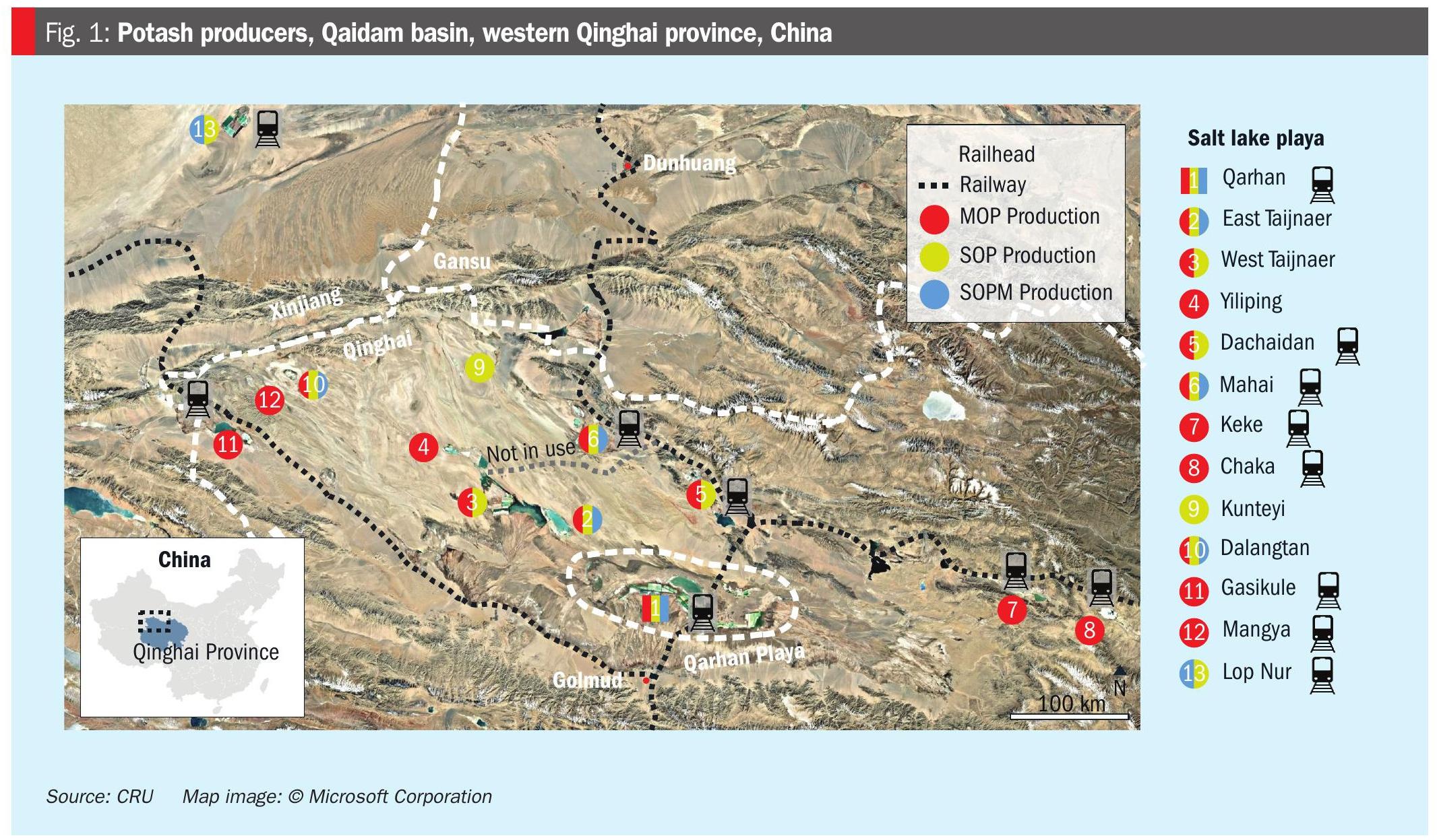

However, the end destination was well worth it, as I was able to visit many of the region’s potash producers scattered across this basin, both large and small (Figure 1).

Chinese potash production – largely fragmented

The Qaidam basin in China’s western Qinghai province is home to almost the entirety of the country’s potassium chloride (MOP) capacity and a substantial portion of its primary potassium sulphate (SOP) and potassium magnesium sulphate (SOPM) output (Figure 2). Additionally, the eastern edge of the adjacent Tarim basin in neighbouring Xinjiang province also houses SDIC Luobupo’s 1.8 million tonnes per annum (t/a) SOP plant – the largest of its kind in the world.

Although only two companies account for the majority of the region’s MOP and primary SOP production – Qinghai Salt Lake (QSL) and SDIC Luobupo, respectively – myriad operators have proliferated across this salt lake playa. Consequently, capacity in Qinghai is the most fragmented of any major potash production centre globally.

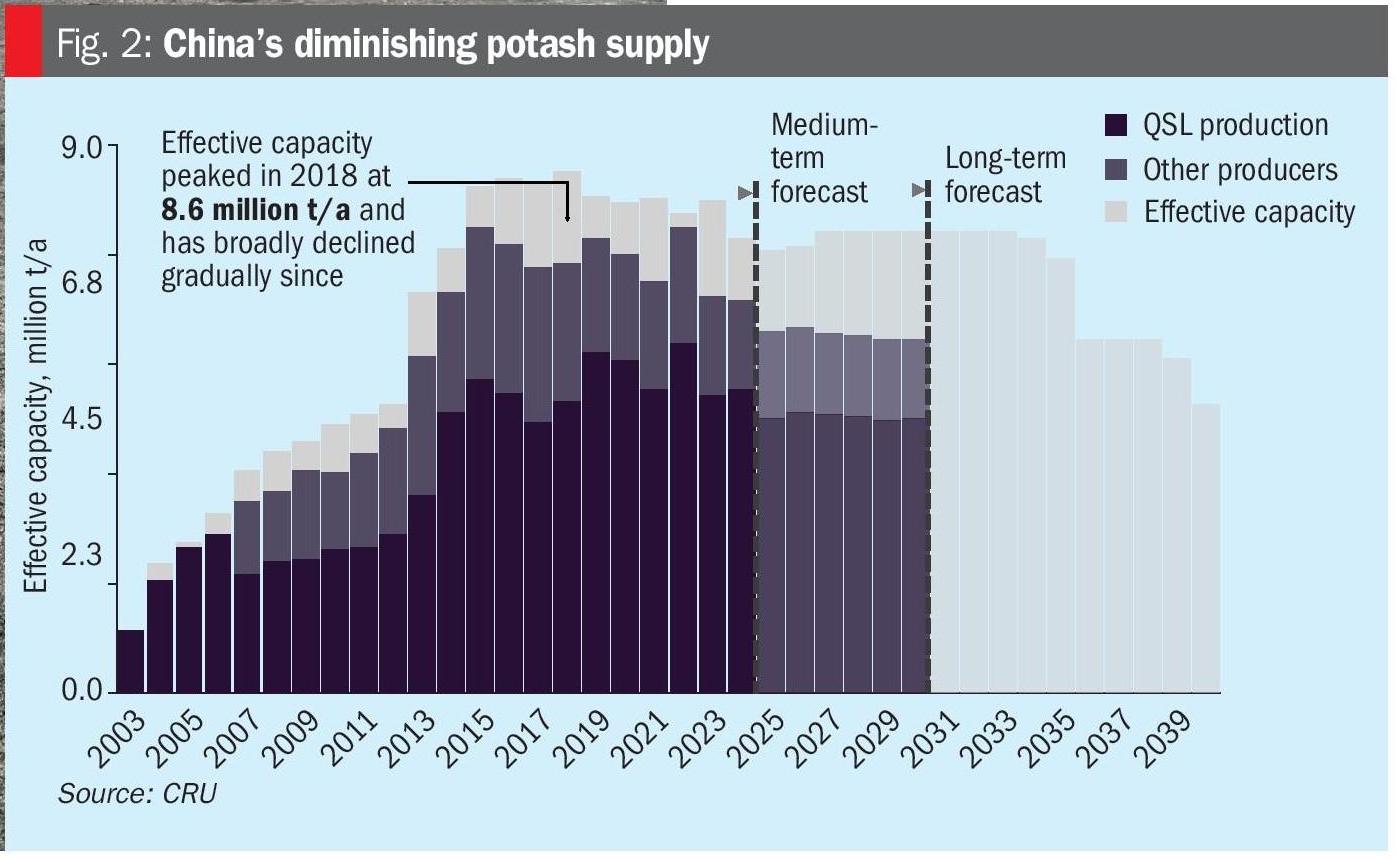

This area of western Qinghai and eastern Xinjiang encompasses nearly all of China’s domestic potash resources. The rapid development of the region’s potash extractive industry during the late 2000s and early 2010s – which resulted in total potash capacity peaking in 2018 – is, however, now leading to significant resource depletion.

The upshot has been that MOP capacity and production has declined throughout the 2020s, albeit slowly and inconsistently. Symbolically, output in 2024 – a fraction above 6.5 million tonnes – was the lowest recorded in eleven years.

On CRU’s prior visit to Qinghai seven years ago, a number of smaller operations had ceased MOP production in favour of SOP, while some had temporarily idled production in the preceding 2-3 years. Yet very few had actually closed for good.

That is now changing with permanent closures becoming more common in the 2020s. China’s nameplate MOP capacity has fallen by 0.8 million t/a since 2018, CRU estimates, equivalent to a 0.9 million t/a fall in effective capacity. Production unit closures at Zangge Potash, Qinghai’s second largest MOP supplier, have been the most significant, with worsening resource constraints seeing the company’s effective capacity drop from 1.9 million t/a in 2018 to just 1.1 million t/a this year.

Zangge operates a cluster of smaller refineries on the southeastern periphery of the large Qarhan playa. On this year’s visit to Qinghai, it was clear that the company had permanently shuttered six of its smaller units, leaving just its largest two potash production units in service.

Additionally, it was apparent that a further 50,000-60,000 t/a of MOP refinery capacity, from the smaller operators outside the Qarhan playa, has permanently closed since CRU’s previous visit, generally due to resource depletion.

Resource depletion to cause further output falls

While potash production in Qinghai and Xinjiang provinces has varied since capacity peaked in the late 2010s, its future trajectory, in CRU’s view, is reasonably clear: downwards. Resource depletion is already beginning to hit Chinese MOP output – and the same will eventually occur with primary SOP too.

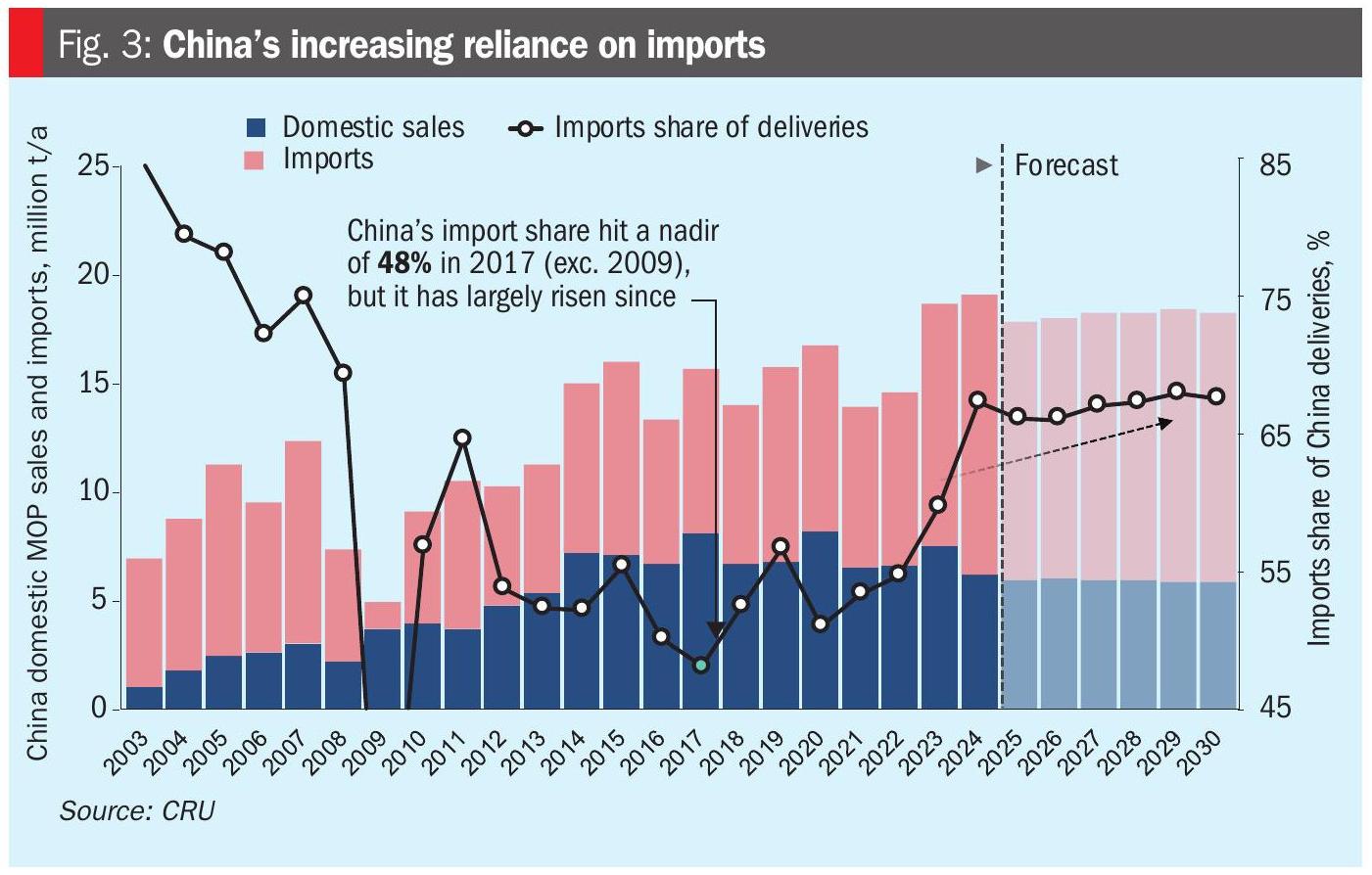

Consequently, China is becoming increasingly reliant on imported MOP to fulfil its domestic potash requirements, both directly and indirectly via the consumption of MOP in secondary SOP production (Figure 3). At their peak in the late 2010s, operations in Qinghai supplied just over half of China’s annual MOP demand. But with reliance on imports only going to rise further, as resources in Qinghai and Xinjiang continue to dwindle, China will become increasingly exposed to international pricing, over which it has limited influence. This is fuelling renewed Chinese business interest in developing international potash projects in countries far beyond the country’s own borders.

Chinese firms look abroad to secure supply

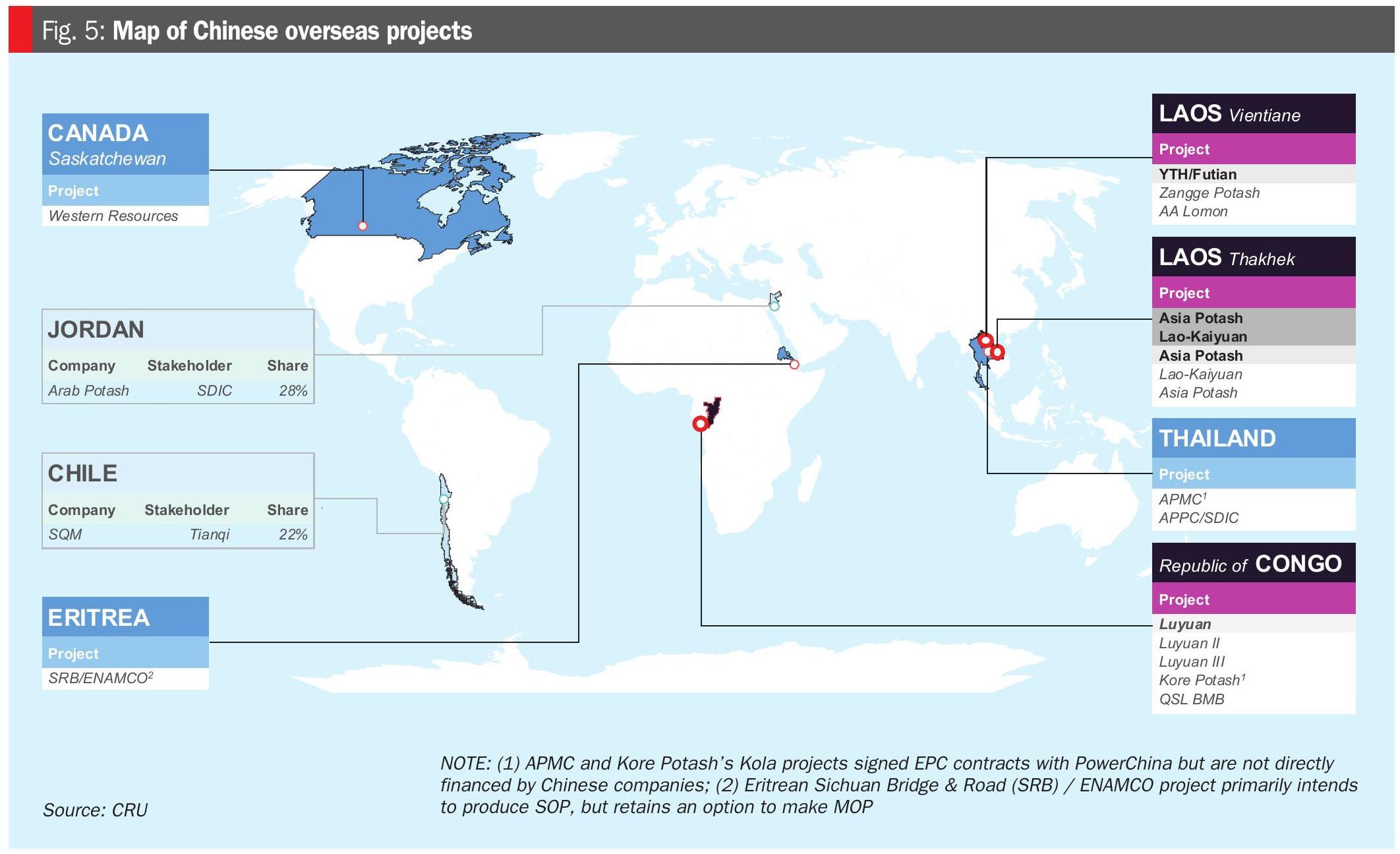

In the late 2000s and early 2010s, Chinese companies – ranging from large state-owned enterprises to smaller private entities – began to develop or participate in a number of international potash projects. China’s interest in these followed the surge in global MOP prices seen in 2007/08, with both neighbouring Laos and Saskatchewan, Canada, being being key centres of interest. Chinese enterprises also pursued projects in Thailand, Eritrea and the Republic of Congo. Additionally, The Development Bank of China helped finance Slavkali’s Lyuban project in Belarus. Separately, there was also some interest in extracting the potash associated with lithium projects in South America.

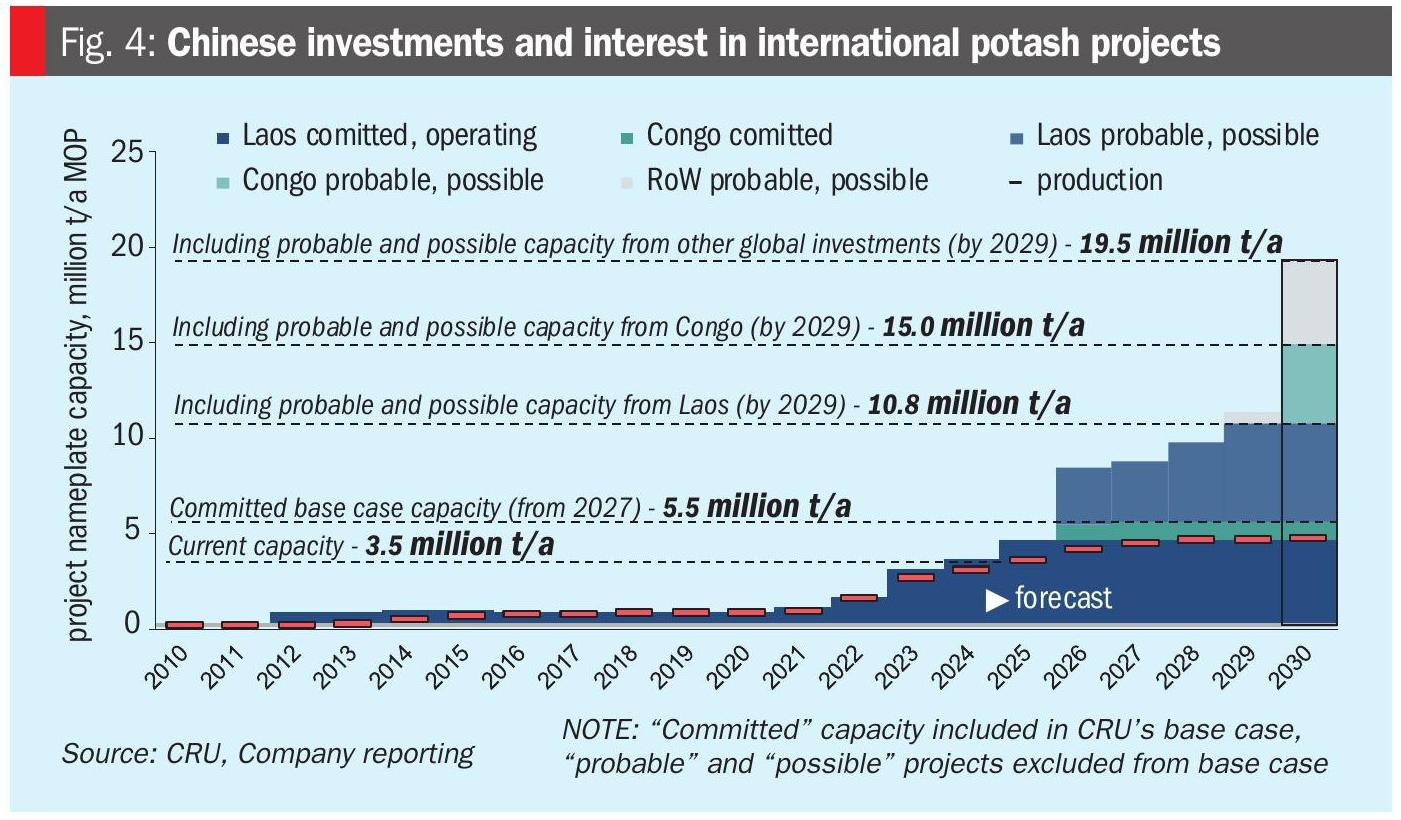

Ultimately, however, the only Chinese-backed potash projects successfully completed during the 2010s – initially at modest scale – were those in Laos, with Lao-Kaiyuan and Sino-Agri Potash Co adding 0.6 million t/a of combined capacity by 2015. Although three other Laos potash projects (two backed by Chinese investors) entered test production in 2011/12, all of these had ceased output by 2016.

Elsewhere, the development of other Chinese-backed projects generally slowed or stopped during the mid-2010s, with none of these reaching fruition outside Laos. The Development Bank of China also stopped financing the Slavkali project in 2021, after western sanctions on Belarus resulted in construction halting.

International investments now delivering supply

Yet, after a false start, China has regrouped this decade and begun investing and participating in international potash projects in earnest (Figure 4). The rapid expansion of Laotian potash projects has exemplified this, with nameplate capacity jumping from a combined 0.75 million t/a in 2020 to 3.0 million t/a in 2024.

With a further 1.0 million t/a of capacity at Asia Potash and 0.5 million t/a from YTH coming online in 2025, Laos’ countrywide capacity is expected to reach 4.5 million t/a this year – making Laos the fifth largest MOP supplier globally, ahead of Israel in nameplate capacity.

Laos is not the only place where Chinese companies are moving forward to develop potash projects. Africa has emerged as a particular construction and investment focus.

In October 2023, Luyuan Mining – a company which has held potash interests in the Republic of Congo for more than a decade – reportedly began construction of a 2.0 million t/a capacity conventional underground mine at Mboukoumassi, near the Atlantic port of Pointe-Noire.

Luyuan, which was previously backed by China’s CITIC, is wholly owned by Shenzhen CATIC Resources, itself a subsidiary of Ganfeng Lithium, China’s largest lithium producer. Shenzhen initially provided Luyuan with RMB350 million (c.$50 million) of debt finance, representing around 10% of the project’s total development capital. While CRU currently classes the overall project as ‘probable’, pending further information about its funding status, we rate the completion of first one million t/a of capacity at Mboukoumassi as ‘firm’.

Also in the Republic of Congo, London-listed Kore Potash signed an engineering, procurement and construction (EPC) contract with PowerChina in November 2024 for its flagship 2.2 million t/a capacity Kola project. This move could potentially lead to direct Chinese investment in the project.

Furthermore, Qinghai Salt Lake, China’s biggest domestic MOP producer, has also been evaluating potential MOP projects in the country, according to recent reports.

For many years, the Sintoukola potash basin has been the focus of MOP project development within the Republic of Congo. Indeed, historically, some of these projects have reached relatively advanced stages. But the combination of the basin’s mainly carnallite ore geology, plus the country’s high-risk investment environment, has ultimately meant no potash capacity has been successfully installed in the country since the 1970s.

“China has regrouped this decade and begun investing and participating in international potash projects in earnest. The rapid expansion of projects in Laos has exemplified this.”

Canadian developer MagMinerals, for example, enlisted the services of various Chinese enterprises during the development of its 1.2 million t/a capacity Mengo MOP project in the basin. Disappointingly, having initiated construction in 2013, the venture eventually fell apart little more than a year later.

Whether the two latest attempts to start MOP production in the Republic of Congo will succeed remains uncertain. Nonetheless, recent project moves, such as Luyuan entering construction and PowerChina agreeing an EPC contract with Kore Potash, do clearly signal a resurgence in Chinese project participation and investment. Generally, the renewed focus on the Republic of Congo also highlights the higher risk appetite of Chinese companies, especially when coupled with the freedom to exert more influence and control over potash projects in the country than is possible elsewhere.

Conclusions

After a period of capacity building and growth in output, followed by production stability, China’s potash industry is now entering a final phase of managed decline. China’s reliance on imports and exposure to global prices will therefore rise, as the depletion of resources in Qaidam and eastern Xinjiang causes MOP output to fall. As outlined in this article, it is this prospect of domestic decline that is pushing Chinese firms to secure potash supply through accelerated overseas projects in Laos, the Republic of Congo and further afield (Figure 5).

About the author

Alexander Chreky is a Fertilizer Analyst and potash market specialist at CRU.

Email: alexander.chreky@crugroup.com

Tel: +44 20 7903 2216