Nitrogen+Syngas 398 Nov-Dec 2025

19 November 2025

Indonesia’s push for new urea capacity

INDONESIA

Indonesia’s push for new urea capacity

Already a large urea supplier to the region, Indonesia has plans for several new plants to monetise its natural gas resources.

Indonesia’s economy is the largest in Southeast Asia, with GDP projected to grow at around 5% in 2025. Already a G20 member, the country is focused on structural reforms and sustainable development to become one of the world’s top five economies by 2050. The economy expanded by around 5% in 2024, with similar growth rates projected for 2025 (the official government forecast is 5.2%, though other forecasts like the OECD and IMF are around 4.7-5.0%). This growth is mainly underpinned by private consumption, which accounts for over half of GDP, and robust investment.

One key to the development of Indonesia’s economy has been exploitation of its considerable natural resources. Indonesia holds the world’s largest nickel reserves and significant deposits of other critical minerals, the government has banned exports of unprocessed minerals to force domestic processing (“downstreaming”), attracting foreign direct investment in higher value-added industries like electric vehicle (EV) battery production. However, with the world’s fourth-largest population and a large, growing working-age demographic, domestic consumption is the primary engine of economic growth.

Feedstock resources

Indonesia holds substantial natural gas reserves, the third highest in the Asia-Pacific region after China. Proven reserves were estimated at 49.7 tcf in 2021. It is also the fourth-largest natural gas producer in Asia, behind China, Australia, and Malaysia. However, a key challenge is decreasing production from older, mature fields, necessitating the development of new resources. Production has fallen from 76 bcm in 2015 to 63 bcm in 2022, although this picked up in 2023 and 2024. The government has a goal of 120 bcm/year production by 2030, which will require substantial investment. The industrial sector is the largest consumer, accounting for around 77% of total final consumption, with the fertilizer industry prominent among these consumers. The “Specific Natural Gas Price” (HGBT) program caps prices at $6.50/MMBtu for certain industries to support growth.

The scattered island nature of the country has discouraged pipeline building and prompted a focus on LNG development; Indonesia and Malaysia were among the pioneers of the LNG industry, dating back to the gas boom of the 1980s. But there are also several high-profile projects to generate future supply, including Abadi LNG (Masela Block), operated by Inpex, which is aiming for production in the early 2030s after numerous delays. BP operates the Tangguh gas project in West Papua, which is undergoing a $7 billion expansion (Train 3) to boost LNG production capacity significantly. Eni has acquired Chevron’s stake in this project in the Makassar Strait and has made a significant discovery at the Geng North field, which is expected to come online around 2027 and channel gas to the Bontang fertilizer complex.

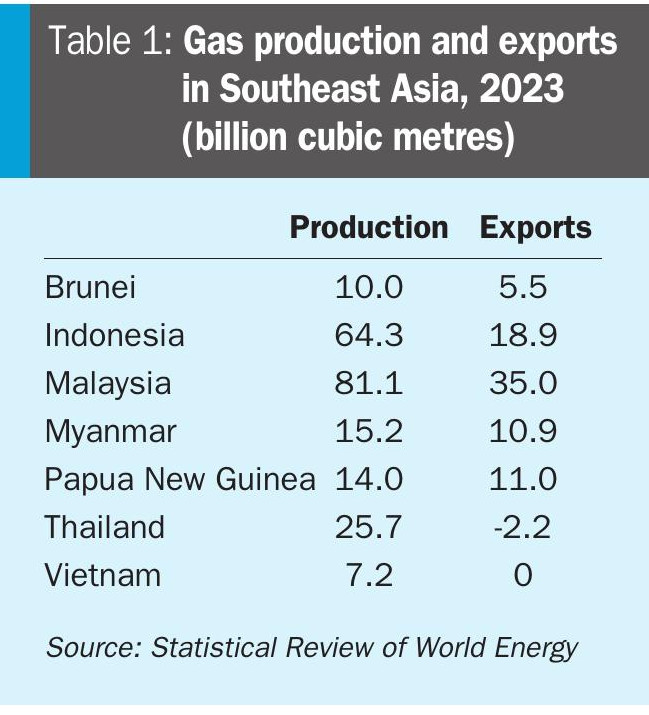

As Table 1 shows, Indonesia is not the largest gas producer or exporter in the region; that title now goes to neighbouring Malaysia, also a significant urea producer, though by no means as much as Indonesia. Brunei, Myanmar and New Guinea are also now large LNG exporters, while Vietnam is self sufficient and Thailand remains a net importer in spite of recent improvements in domestic natural gas production.

There are also major coal reserves in the region. Indonesia has by far the largest reserves, and produced 775 million tonnes of coal in 2023, of which it exported two thirds, mainly to China. Coal production has increased by 60% over the past decade, and Indonesia is actually the world’s largest coal exporter, surpassing even Australia.

Fertilizer production

Indonesia’s ammonia and urea production developed on the back of natural gas discoveries in the 1970s and 80s, when the fragmented nature of the region with its myriad islands meant that local outlets for many gas finds were limited due to lack of pipeline capacity, and a number of ammonia-urea projects were built based on what was then ‘stranded’ natural gas. By 1989 Indonesia had 5.3 million t/a of urea capacity and was the largest exporter in the region. Six more urea plants followed in the 1990s and 2000s; two at Bontang, one at Lhokseumawe, one at Cikampek, one at Gresik, and a replacement plant for Pusri at Palembang, which added in total another 2.7 million t/a of urea capacity. However, by now rapid industrialisation was leading to greater domestic demands for gas for power production, while maturing gas fields began to reduce feedstock availability to some locations, leading to the closure of the ASEAN Aceh urea plant in 2004. Urea consumption also rose within Indonesia, and the government began to restrict exports at certain times of year. Urea exports peaked in 1997 at 2.4 million t/a, and by 2004 fell to below 500,000 t/a. Rising gas prices, meanwhile, were impacting upon company margins.

In spite of this, Indonesia has continued to build newer more modern facilities to replace older plants that are being taken out of service. In 2015, Kaltim started up its Kaltim-V urea plant, with a capacity of 1.1 million t/a of urea, to replace the ageing Kaltim-I plant, and in 2017 Pusri likewise replaced the Pusri II plant with the 900,000 t/a Pusri IIB. By 2018, Indonesian urea production had risen to 7.4 million t/a, and exports were back up to 1.1 million t/a. In December 2018, a new 700,000 t/a standalone ammonia plant was commissioned by PT Panca Amara Utama (PAU) in Sulawesi, and Indonesian urea production has average around 7.7 million t/a since 2019. By 2021 urea exports had increased back to 2 million t/a, though a recovery in domestic demand since then means that this has fallen back to 1.4 million t/a in 2024.

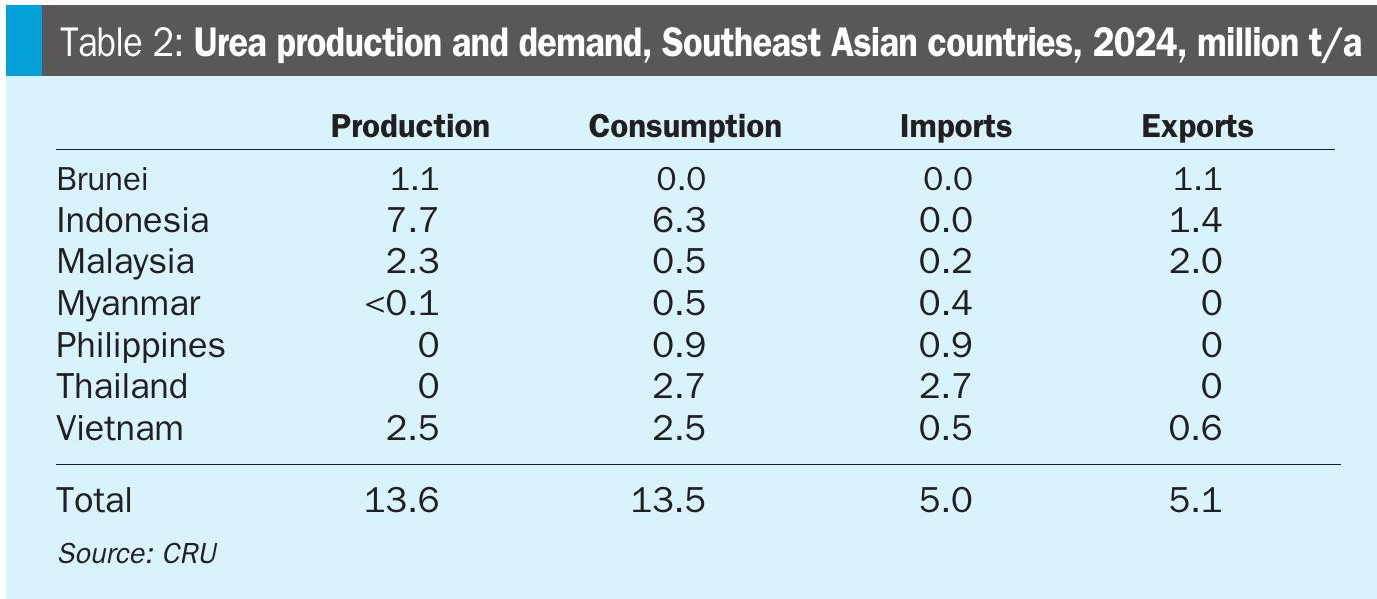

Regionally, as shown in Table 2, Indonesia remains the largest producer of urea, though Malaysia is actually a larger exporter due to increasing domestic Indonesian demand for urea. Vietnam is roughly self-sufficient in urea, while Thailand, Myanmar and the Philippines are all significant importers. Overall, however, the Southeast Asian market is roughly balanced.

Self-sufficiency

The Indonesian government continues to prioritise national food self-sufficiency and reduce reliance on imports. In 2024, the government said that it was working with state fertilizer groups on around $6 billion of new ammonia/urea plants to help curb food costs and reduce import dependence. The announcement, though slightly speculative, envisaged a combination of new plant construction and the revitalisation of existing facilities, in order to dramatically increase its domestic urea production capacity.

The primary catalyst for this is Indonesia’s long-standing goal of bolstering national food security. Agriculture is a cornerstone of the Indonesian economy, and ensuring farmers have access to sufficient, affordable fertilizer, particularly urea and NPK, is critical for boosting crop yields, especially for key commodities like rice and soybeans. Historically, the country has navigated a complex balance between domestic needs and export opportunities. In recent years, concerns over food security have led the government to implement stricter controls on urea exports, prioritising local market demand. This policy shift became more pronounced in 2024 and 2025, with state-owned fertilizer group PT Pupuk Indonesia (Persero) directed to ensure the availability of subsidised fertilizers for domestic farmers before considering international sales. The government has increased its fertilizer subsidy allocation to around IDR 39 trillion (approximately $2.5 billion) to aid farmers, a clear indication of the priority placed on domestic agricultural productivity.

The new production facilities are central to this strategy, designed to guarantee a stable and plentiful domestic supply, thereby stabilizing food costs and enhancing the resilience of the agricultural sector.

New urea plants

At present there are two large-scale expansion projects underway; a new greenfield plant in Fakfak, West Papua, and the revitalisation of the Palembang complex on South Sumatra via the new Pusri-IIIB facility. Pusri IIIB is a continuation of the company’s modernisation programme, as when it replaced the ageing Pusri II plant several years ago. PT Pupuk Indonesia is replacing its old Pusri-III and Pusri-IV trains with the advanced Pusri-IIIB plant. This project represents an investment of around $670 million and is expected to produce approximately 900,000 t/a of urea and 445,000 t/a of ammonia. Pupuk Indonesia has licensed KBR’s Purifier™ ammonia technology, improving energy consumption on the older plants, with a quoted specific energy consumption for urea production at 21.97 MMBtu per tonne and for ammonia at 32.89 MMBtu/tonne. Toyo is providing its ACES21 technology for the urea unit. Construction began in 2023, and the plant is expected to be on-stream in 2027.

The Fakfak Project on West Papua is being spearheaded by PT Pupuk Kalimantan Timur (Pupuk Kaltim), a subsidiary of Pupuk Indonesia. With an investment exceeding $1 billion, this facility is designed to produce 1.15 million t/a of urea and 825,000 t/a of ammonia. The Fakfak plant is strategically located to meet the growing fertilizer demand in Indonesia’s eastern regions, where logistical costs for transporting fertilizer from western production hubs have historically been a challenge. Expected to be operational around early 2028, the plant is also aligned with the government’s plans to expand agricultural land, particularly for paddy fields in nearby Merauke, which is projected to create a local demand for around 500,000 t/a of urea and NPK fertilizers.

Other potential projects include a blue ammonia and possibly urea plant being developed by PT Pupuk Indonesia on Yamdena. A heads of agreement was signed this year with a provisional on-stream date of 2030, but it is not believed that FEED work has been completed. Pupuk Indonesia says that it plans to use gas supply from the Abadi Field to operate the ammonia plant. This plant is estimated to require a long-term gas supply of 150 million scf/d.

Pupuk Kujang has also discussed a gas-based ammonia-urea project at Senoro on Sulawesi, but there has been no update for some time. There have also been discussions around a coal-based urea plant, but this seems to have been shelved due to environmental concerns.

Recently, however, the Indonesian government has announced that it aims to establish a total of seven new fertilizer plants across the country, with five of them completed by 2029, at an estimated total investment of around IDR 50 trillion ($3 billion). The figure includes the Pusri and Fakfak plants already under development, as well as the Yamdena CCS project, and other potential projects at Gresik, Kujang and Bukit Asam. The ultimate goal is to increase the total subsidised fertilizer production capacity significantly, ensuring a robust national supply that can handle fluctuations in global markets and reduce dependence on external sources. Pupuk Indonesia has signed two preliminary agreements to explore cooperation in the utilisation of natural gas from two oil and gas projects, namely the Masela Working Area and the Andaman South Working Area as feed for the plants. Agriculture Minister Andi Amran Sulaiman said during a press conference in October this year that the new plants will be energy-efficient, helping reduce production costs. While older factories allocate up to 43% of their operational costs for gas, the new facilities are expected to spend only around 22–23%, he said. He added that the construction budget will be sourced from efficiency programmes implemented by the ministry. Adjustments to subsidised fertilizer management, which emphasise upstream aspects, have also contributed to funding the new plants. The minister further stated that the establishment of new plants will create opportunities to gradually increase subsidized fertilizer production to 700,000 t/a by 2029.

Challenges

Ambitious plans tend to require overcoming significant hurdles. While the government insists that the funding required can be met from existing budgets, securing the substantial funding required can be a complex endeavour, involving syndication from various state-owned and private entities. Furthermore, ensuring a stable and cost-effective supply of natural gas, the primary feedstock for conventional ammonia and urea production, remains crucial. There are also still question marks over the use of CCS technology such as is anticipated at Yamdena. As a result, CRU currently only considers the Pusri IIIB project to be firm, with Fakfak likely, though potentially with slippage in its timeline, and the others still speculative at this stage.