Sulphur 420 Sep-Oct 2025

19 September 2025

Phosphate production in North Africa

NORTH AFRICA

Phosphate production in North Africa

North Africa remains a major centre of global phosphate production, with significant production in Algeria, Tunisia and Egypt as well as Morocco, and sulphur and sulphuric acid consumption continuing to increase.

North Africa is one of the world’s largest phosphate producing regions, and contains nearly 85% of the world’s phosphate reserves. Because of the lack of domestic sulphur recovery or smelter acid production, this means that the region’s phosphate industry is a major consumer and importer of sulphur and sulphuric acid, and hence expansions in the region’s phosphate industry continue to be a major driver of new sulphur consumption.

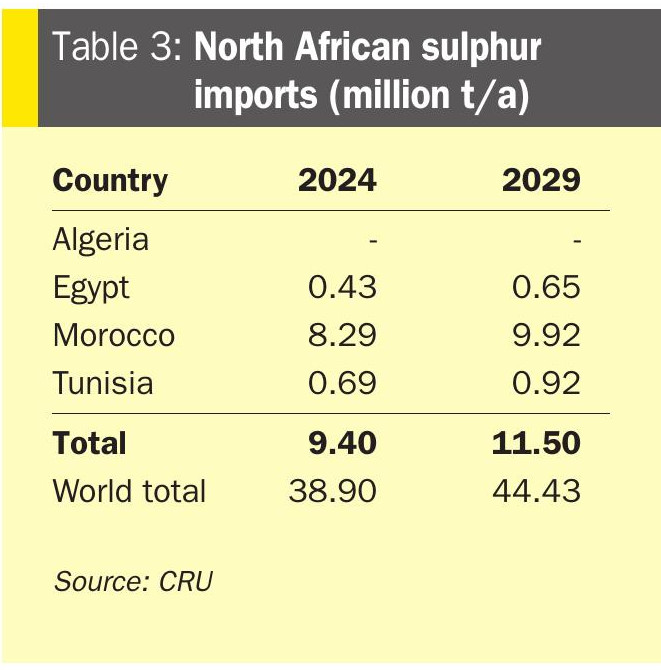

Table 1 shows North Africa’s phosphate rock production over the past decade. While the region represents only around 21% of global phosphate rock production, that output has grown by 10 million t/a of phosphate rock over the past decade, at a time when global production has only increased by 20 million t/a, making North Africa the fastest growing region for new rock output. Still more notable is that even though only about 35% of the region’s rock production was exported, North Africa nevertheless represented almost half of all internationally traded phosphate rock in both 2014 and 2024. But also notable is that the remaining 65% of mined rock was processed domestically, though this varied widely between Algeria, which processes a negligible fraction of its rock production, to Tunisia, which processes almost all of it. The largest producer is of course Morocco, and here the proportion of rock production which is processed domestically has risen from 68% to 82%, at a time when that total rock output has risen by 30% in a decade, as OCP continues to expand its production and builds more processing capacity to capture more of the value chain. Morocco represents 8 million t/a of the additional 10 million t/a of new phosphate production over the past decade.

Morocco

Morocco remains the dominant nation not just in North Africa but in the global phosphate industry. The country’s phosphate business is almost entirely in the hands of state-owned Office Cherefien des Phosphates (OCP). OCP represents a major sector of the country’s economy, employing 21,000 people and accounting for 20-25% of Morocco’s exports by value and about 5% of its GDP.

OCP mines phosphate rock at three main sites: Khouribga in the north of Morocco, the more central Gantour region (Benguerir and Youssoufia) and Boucraa in the south. OCP divides its business geographically. The company’s three main cash-generating units, known as the Northern Axis (Khouribga–Jorf Lasfar), the Central Axis (Benguerir and YoussoufiaSafi) and the Phosboucraa Axis (Boucraa– Laâyoune), reflect the separate centres of mining and processing in Morocco and their associated downstream chemical assets. The largest is the northern axis, where phosphate ore is transported by slurry pipeline to the vast Jorf Lasfar Phosphate Hub complex, where it is processed into phosphoric acid and finished phosphate fertilizers for export.

Moroccan rock production actually took a dip from a peak in 2021 of 38 million t/a to 30.5 million t/a in 2022 in terms of beneficiated rock transported downstream, and mined volumes fell lower still as global demand was impacted by a run of high prices. The fall in production, coupled with a higher proportion of rock being processed domestically, led to Morocco’s rock exports falling below Jordan’s from 2022, and even by 2024 Jordan was still exporting slightly more rock than Morocco. This was part of a supply management strategy initiated by OCP, aiming to better align the implied value of phosphate contained within its rock, phosphoric acid and downstream fertilizer products.

However, ore production has recovered since, and increased by almost 50% in 2024 to 45 million tonnes of rock (35.3 million t/a was supplied downstream). Furthermore, in 2024, OCP initiated a new development plan to substantially expand its phosphate rock capacity before the end of the decade. In total, it intends to potentially increase its company-wide capacity by 22.5 million t/a, reaching as much as around 70 million t/a. This new plan focuses more heavily on the central Meskala-Gantour axis and, to a lesser extent, the southern Boucraâ-Laâyoune axis. At the former, OCP will expand the Ben Guerir rock mine by 6.0 million t/a to 10.2 million t/a, with construction reportedly already underway. Beyond that, the company intends to construct new mines at Meskala and Louta, potentially adding a total of 14.0 million t/a. However, these are at an earlier stage of development and CRU does not yet include them within its base case. Finally, OCP will expand its southern Boucraâ mine by 1.5 million t/a to 5.5 million t/a.

Further to the rock capacity additions, OCP also has ambitious plans for significant downstream phosphate fertilizer capacity expansions, mostly focused on triple superphosphate (TSP). The company has recently commissioned three 1 million t/a granulation units at Jorf Lasfar; the first in 2023, and the others in 2024. These lines can produce DAP and MAP, but currently only produce TSP. Furthermore, the company aims to establish a further 1 million t/a TSP Hub in Jorf Lasfar. Outside Jorf Lasfar, the company to construct a large complex called the Mzinda Phosphate Hub. This does not appear to have ammonia processing capabilities attached to it and will exclusively produce TSP. OCP intends to open the facility in 2025 at an initial capacity of 2.1 million t/a before adding a further 2.0 million t/a in 2026.

Over the next five years. DAP and MAP exports are expected to grow significantly more slowly, as new TSP capacity frees flexible plants for DAP and MAP production. The growth of TSP exports will not be dependent on supply, which is plentiful, but on OCP’s ability to expand existing markets and create new ones. OCP has pushed heavily for adoption in India, recently signing a 1.2 million t/a of DAP and 800,000 t/a of TSP supply deal. TSP is better suited to some Brazilian soils and could replace some MAP volumes there. OCP is also pursuing purified phosphoric acid (PPA) capacity, announcing in 2023 plans to build four PPA units as part of its strategy to meet growing demand for PPA, technical MAP, LFP cathode materials, and phosphate salts for food and industrial applications. The first phase of the project consists of 200,000 t/a P2 O5 pretreated phosphoric acid capacity, 100,000 t/a P2 O5 PPA capacity, and 100,000 t/year technical MAP (tMAP) capacity. The PPA project will be constructed in conjunction with JESA, a joint venture between OCP and African technology, design, and engineering company WorleyParsons. Completion of the four plants is scheduled for 2026-29.

As well as developments in Morocco, OCP has looked to develop partnerships globally, especially across Africa, in the hope of stimulating more demand for its phosphates via its OCP Africa subsidiary. In some countries, including Nigeria, it has invested in blending units where products are customised to suit local soil and crop needs.

Algeria

Algeria has the world’s third largest reserves of phosphates after Morocco and China, at 2.2 billion tonnes P2O5 . Algeria’s reserves are mainly the westward extension of Tunisia’s Gafsa basin, with several prominent deposits running along the border with Tunisia. The Government-owned Enterprise Nationale de Fer et du Phosphate (Ferphos) manages Algeria’s production of iron ore, phosphate rock, and other key minerals, with phosphate mining conducted by its subsidiary Société des Mines de Phosphates SpA (Somiphos). Somiphos’ key site is the Djebel-Onk complex, where there are an estimated 2.8 billion tonnes of phosphate rock deposits at 25-28% P2O5 . Two main mines send phosphate rock to a 2 million t/a capacity beneficiation plant and onwards for export at the port of Annaba. A small amount is consumed domestically, but almost all of Somiphos’ production is exported.

Algeria has tried to develop downstream phosphate processing capacity, initially with Indonesia’s Indorama, and then with Chinese partners, but there had been little headway until earlier this year, when the Algerian Chinese Fertilizers Company (ACFC) launched a $7 billion integrated phosphate project (PPI) in the country’s Tebessa province. ACFC was formed in 2022 as a joint venture between Algerian firms Manal and Asmidal, a subsidiary of Algerian energy giant Sonatrach, and Chinese firms Wuhuan Engineering and Tian’An Chemical. The project aims to develop and exploit the Bled El Hadba phosphate deposit at Djebel Onk, with the two Algerian firms owning 56% of ACFC and the two Chinese companies owning the remaining 44%. The project includes increasing the rock output of the Bled El-Hadba mine from one million t/a to 10 million t/a, with downstream 1.2 million t/a of ammonia production and 4 million t/a of finished phosphates, including MAP and DAP.

Tunisia

Tunisia’s reserves of phosphate rock are smaller than its neighbours to the west, but there had been more investment in their development than in Algeria, and by 2010 Tunisia was the world’s fifth largest producer of phosphate rock, after China, the USA, Morocco and Russia, producing 8.1 million tonnes of rock, and the industry still represents 15% of national exports and 4% of GDP. Two state owned companies operate Tunisia’s phosphate sector; phosphate mining company Compagnie des Phosphates de Gafsa (CPG) and its downstream customer and processed phosphate producer Groupe Chimique Tunisien (GCT).

However, like neighbouring Algeria, Tunisia’s phosphate industry has been a casualty of domestic political infighting, with sites blockaded by workers seeking higher wages following the 2011 ‘Arab Spring’, and CPG and GCT the target of public protests and government corruption investigations. In spite of several government attempts to boost production to ease its financial situation, rock output and hence downstream processing has fallen, as Table 1 shows. The latest plan envisages raising phosphate production five-fold to 14 million t/a in 2030, the government said in March 2025, but achieving this remains an ambition rather than a likelihood.

Egypt

Egypt produced 7.5 million tonnes of phosphate rock in 2024, making it the seventh largest producer in the world after China, the USA, Morocco, Russia, Jordan and Saudi Arabia. It is also the world’s third largest exporter of rock, after Morocco and Jordan. Egypt has some of the lowest production costs for its phosphate rock, and the government has decided to expand production and, like Morocco, capture more of it via downstream processing of phosphate rock. Egypt’s phosphate deposits occur in a wide belt across the centre of the country, stretching from the Red Sea inland through the Nile Valley and into the New Valley in the Western Desert. Mining is in the hands of several companies, but the two largest are the state owned Misr Phosphates and the military-owned El Nasr Company.

Egypt continues to be a major site for investment in its phosphate industry. Last year Misr Phosphates inaugurated a new phosphate rock line at its Abu Tartour site with a capacity of 750,000 t/a. Wilson International Trading has also signed an agreement with El-Nasr Mining Company and Al-Safy Group to build a high-grade phosphate rock mine. Earlier this year the Egyptian Mineral Resources and Mining Industries Authority signed a memorandum of understanding with El Sewedy Capital Investments to establish a partnership for the exploration, exploitation, and production of phosphate rock in the El-Sebaeya region of the Nile valley, with downstream beneficiation and a feasibility study for establishing a factory to produce phosphate fertilizers.

Chinese phosphate and battery chemical producer Chuan Jin Nuo Chemical (KMCJNC) has announced a $265 million plan to build a plant in Egypt to produce a range of intermediates and finished products. Planned capacities for the site are 800,000 t/a of sulphuric acid and 300,000 t/a of ammonium phosphate per year. Egypt has also signed a deal with two Chinese companies to build a phosphoric acid plant in Abu Tartour. The project aims to use domestically sourced rock to build a capacity of 250,000 t/a of phosphoric acid.

Sulphur imports

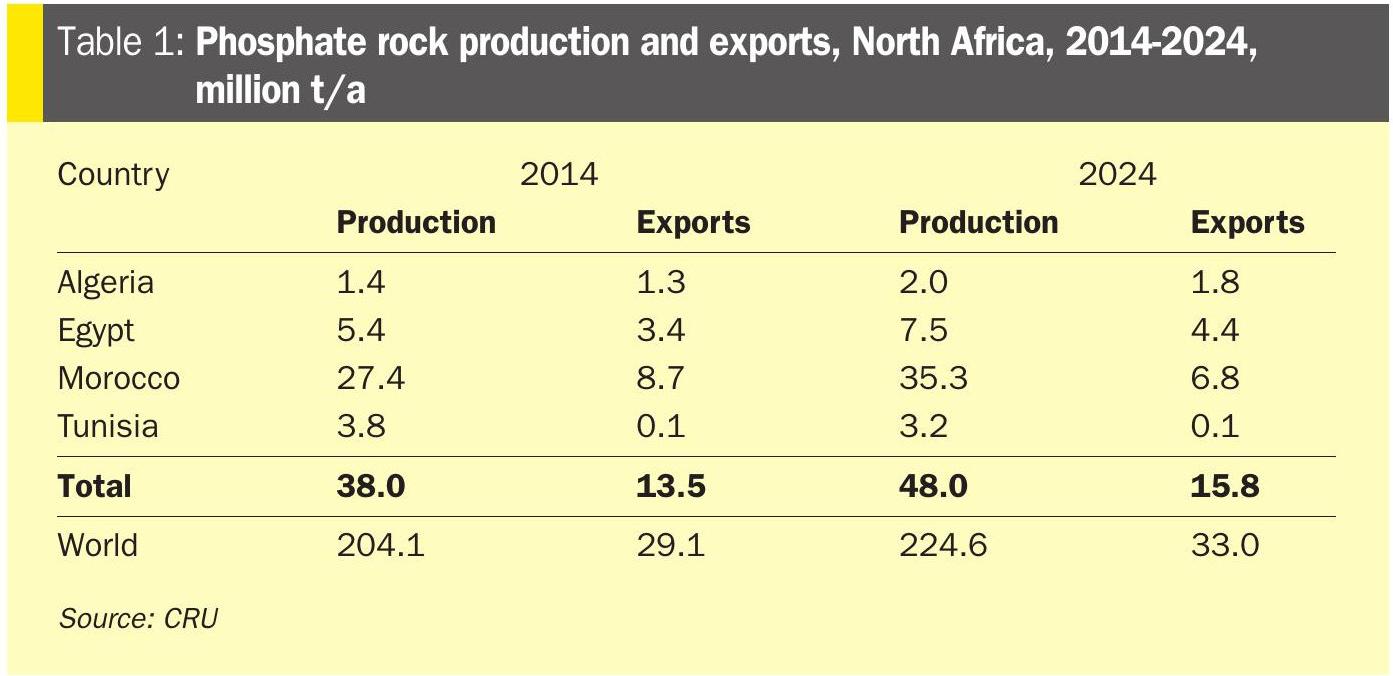

Table 2 shows North Africa’s overall phosphoric acid production for downstream phosphates processing. This translates to a total of about 29 million t/a of sulphuric acid consumption; around 2.1 million t/a each in Egypt and Tunisia, and 24.7 million t/a in Morocco.

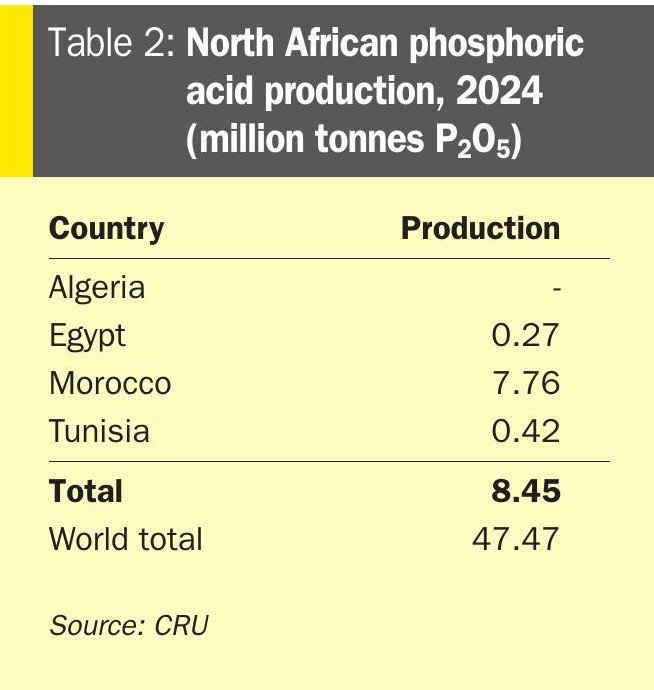

Neither Algeria or Tunisia have any appreciable elemental sulphur production. Morocco has around 100,000 t/a of sulphur, and Egypt slightly higher at 310,000 t/a from its refining sector. The growth of domestic phosphate industries in North Africa thus inevitably requires large volumes of sulphur and/or sulphuric acid imports in order to feed phosphoric acid production. Sulphur imports for 2024 were 430,000 t/a for Egypt, 690,000 t/a for Tunisia, and 8.29 million t/a for Morocco, making the latter the world’s largest importer of sulphur, and North Africa the destination for around 25% of all globally traded sulphur.

Over the next five years, as shown in in Table 3, this is projected to increase due extra capacity coming onstream in all three importing countries, but particularly Morocco, where imports will rise to just under 10 million t/a. Morocco also imported 2.0 million t/a of sulphuric acid in 2024, although this figure is likely to fall by 2029 as more domestic sulphur burning acid capacity come onstream. At present the new Tebessa project in Algeria is not included in the figures, but if development proves faster than expected, this could also add more sulphur requirements for Algeria.