Community

19 May 2025

IFA 2025 Annual Conference report

Driving change

Around 1,400 delegates gathered in Monaco last week for the International Fertilizer Association’s Annual Conference. The Association’s CEO Alzbeta Klein framed this year’s annual conference as a call to action. Writing in CRU’s Fertilizer International magazine, she said: “It’s an opportunity to shape the future of agriculture and food production.”

“Let’s seize this moment, invest in the future of food and create an industry that not only adapts to change, but drives it. Together we can nourish the planet and power the future,” she said.

If this year’s conference was all about driving change, it was aptly located at the Fairmont Hotel Monte Carlo, overlooking the famous Formula One Fairmont Hairpin, a place renowned for its shifting gears and nifty changes of direction. CRU’s intrepid team was there to lift the bonnet, and even the occasional medicinal Campari, to report on the engine driving the global fertilizer industry as it gathered on the French Riviera. Sincere apologies to all readers for the previous sentence.

“The theme we have chosen for this year’s annual conference, ‘Investing in the Future of Food’, could not be more timely, as we continue to work together to overcome challenges such as geopolitical realignments, shifting consumer demands, environmental imperatives and technological disruptions,” IFA’s Klein said, reflecting on the rapidly changing global backdrop.

CRU’s Sharon Phillips-Davies and Simon Inglethorpe await the delegates rush.

Here are some selected highlights from the conference programme.

What we eat is about to change

IFA’s 2025 annual conference opened with a session on global food markets. Agrifood systems are responsible for more than $11 trillion in hidden environmental, social and health costs. At the same time, the size global food market is growing, with an industry value of over $10 trillion in 2024. Economists point to trillion dollar investment opportunities that have the potential to transform food systems, unlocking opportunities to address food poverty, malnutrition and pollution.

Alison Jackson, managing partner EY Canada, kicked off this year’s event with her keynote on the evolution of the food system.

“This is a sector very near and dear to my heart,” she said. “Fertilizers have always been part of my life being surrounded by wheat corn and soybeans as a child.”

The global food system is fragile and heavily integrated, Jackson said, with trade being the key. “The system is incredibly efficient, yet vulnerable to disruption, given that around 20 crops provide around 70% of food calories. Globally around 20% of calories also cross at least one border to reach their destination.”

Jackson urged the industry to take action in four areas by expanding production, reducing waste, fostering collaboration and managing environmental impacts.

“The potential for new innovation is staggering,” she said, helping food systems to become faster, more productive and more predictable.

On sustainability and waste reduction, circular economy solutions are gaining traction, in her view. IFA’s recently published report on turning phosphogypsum waste into inventory was one example. There is no better place to be than feeding the world, she said.

Saving the planet never tasted so good

The keynote on Farming 4.0 by Michael Twining, Willard’s VP for sales, marketing and business development, was a particular highlight.

“I’m a guy with boots on the ground, with my boots covered in your product,” joked Twining. The recurring theme of his insightful presentation was: what business are we really in?

Ultimately, suggested Twining, we are all in the human nutrition business. The real ambition of our industry should be the production of affordable nutrient-dense foods, in his view, while simultaneously addressing the associated environmental challenges this presents.

Twining was not calling for a revolution. Instead, he was advocating an incremental shift in the fertilizer business towards feeding soils and people.

“We should as an industry lean into the opportunity to feed plants and people better,” Twining said, with consumer demand for nutrient-dense foods on the rise, this sounds like an opportunity for growing high-yielding crops via regenerative agriculture, in his view.

Willard said he was already seeing progressive farmers in the US shift their dollar per acre spend away from P&K to micronutrients, biostimulants, cover crops and no tillage systems.

Twining is championing a new kind of ‘outcomes-based agriculture’ that rewards farmers for improving human nutrition, and taking action on climate change, in addition to remuneration based solely on crop yield.

Rather than just rewarding yield, fertilizer producers need to start rewarding outcomes that food companies are willing to pay us for, urged Twining.

Focus on the engine of Brazil’s economy

Francisco Jardim, partner at SP Ventures, called Brazil’s agribusiness the success story of the century.

“Brazil is by far the biggest surplus ag producer in the world,” he said, having moved from a net food importer 50 years ago.

Brazil feeds 1 billion people across the planet. This is thanks to its status as a top global producer of soybean, corn, cotton, beef, poultry and frozen orange juice.

Agribusiness outperforms Brazil’s general economy having grown by more than 50% over the last decade versus Brazil’s annual GDP growth of 3%. This is largely due to the adoption of technology, Jardim said. The application of technology to agribusiness has helped improve processes, reduce costs and increase efficiency, generating strong results in recent years, he said.

Jardim singled out two key innovations trends – the strong adoption of biologicals and financial technology (fintech) – as key factors in the success of Brazilian agriculture.

The renewed focus on Indonesian food security was highlighted by Bari Hasibuani, expert staff member of Indonesia’s Ministry of Food Affairs, a branch of state established at the end of last year by the country’s incoming president.

Indonesia is now targeting self-sufficiency in food production in the shortest possible time between 2027 and 2029. Agricultural intensification via improvements to fertilizer availability, irrigation and the provision of superior-quality seeds is a core aspect of the food self-sufficiency drive.

Fertilizer provision has a central role in innovation, logistics and farmer engagement Hasibuani said. A new presidential regulation is streamlining domestic procurement and distribution of fertilizers.

Between January and April this year Indonesia distributed 2 Mt of subsidised fertilizers domestically via Pupuk Indonesia to safeguard farm productivity and national food supply. The country has moved to prioritise the allocation of fertilizers for domestic needs including remote and deprived farming areas.

Typical Cote d’Azur scene

IFA’s 2024-2029 outlook

IFA’s medium-term supply outlook was outlined by Etienne Achard, fertilizer demand analyst.

IFA’s assessment of fertilizer supply for 2024 suggests that ammonia supply reached 107.8 million tonnes, phosphoric acid supply reached 30.3 Mt, while MOP supply reached 40.8 Mt. On this basis, both phosphoric acid and MOP hit record supply levels last year, with ammonia falling just short of the record set in 2020.

Over the next five years, IFA expects nitrogen capacity to rise from 195 million nutrient tonnes in 2024 to 215 Mt in 2029 with new projects in Nigeria and Russia driving this.

P2O5 capacity is set to increase from 63 million nutrient tonnes in 2024 to 72 Mt in 2029. In China, capacity additions are focused on production of purified phosphoric acid (PPA) with the electric vehicle market and attendant lithium iron phosphate (LFP) battery growth driving this. The potash capacity outlook shows the biggest increase of the three nutrients. K2O capacity is forecast to increase from 64 million nutrient tonnes in 2024 to 77 Mt by 2029. Canada and Russia are leading the way on capacity additions.

Achard highlighted several key trends in the latest supply outlook out to 2029. Firstly, IFA is forecasting an extra 22 Mt of additional ammonia capacity over this period, with blue ammonia making up 13% of this total and green ammonia 9%. This is a big leap in projected blue ammonia capacity with the percentage at the end of the outlook doubling from the previous assessment IFA made in Singapore last year.

Secondly, unsurprisingly given current price levels, phosphate affordability is on a downward trajectory. This is neatly illustrated by the decline in Brazil’s soybean barter ratio. This has increased from around 30-40 bags/t of P2O5 in 2022 to more than 60 bags/t currently.

Thirdly and finally, Europe is caught between poor production economics and its need to secure fertilizer supply, Achard suggested. Consequently, IFA expects 0.5 Mt nitrogen capacity closures over the next five years, while other analysts are forecasting closures nearer to 4 Mt by 2029.

Amelle Gruere, IFA’s demand programme manager, shared her insights on global fertilizer use. This was expected to reach a new record of 206 million nutrient tonnes in 2024. Better affordability has been the main driver of this aided by supportive policies in both China and India. While nitrogen and potash hit new highs last year, phosphate has lagged.

Gruere expects demand growth to continue over the next five years albeit at a slower pace. IFA’s current projection is for global fertilizer use to rise from 206 Mt in 2024 to 224 million nutrient tonnes in 2029, with South Asia and Latin America providing the main engines of growth.

Fertilizer affordability, weather, and the domestic policy environment look like being the key demand factors going forward. Growth in P2O5 use is expected to continue to lag behind K2O usage out to 2029.

Let’s now turn to the main conference talking points in Monaco.

Mergers, exports & tariffs

The conference revved up swiftly on Day 1. News of two major M&A deals for distribution networks in Australia emerged as delegates were sipping on their first espressos. The M&A deals, by Fertiglobe/Wengfu and Ridley/IPL, dominated talk on the sidelines. Apparently the timing of both on the same day was coincidence, having been in the pipeline for years.

Many questions were asked on the timing of China’s urea exports, and by the start of Day 2 CRU was able to shed a little more light. As we reported 13 May, exports of just 2 Mt urea are to be expected from China from May to April, 2026.

Traders want to know where China’s prilled urea go, if not to India. There was also a good deal of uncertainty over the direction of urea prices, although it seemed from conversations 12 May that most participants were expecting short-term price declines, although a Sabic sale at $387/t FOB, now understood to be for Ethiopia, stood out. We believe is likely unrepeatable.

It also seems the industry is not fully up to speed on CBAM. Many expect further delays or watering down, a position we think is a little risky.

Separately, more clarity on the EU/Russia tariff decision is expected on 21 May with a final decision and vote in the weeks following.

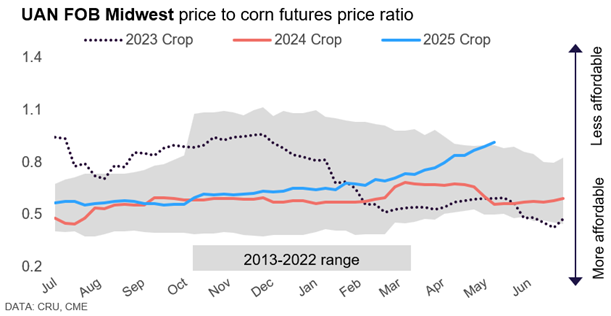

The recent US-China tariff developments have lent more confidence to those hoping to ship material into the US, but it has been very difficult to execute on cargoes into that market, which contributed to the recent surge in US prices. Very good planting conditions and potentially even more corn acres will add to the upside over the coming months. Here’s a nice chart from our US demand analyst that illustrates the US situation well…

First WASDE for 2025/26

The USDA’s World Agricultural Supply and Demand Estimates (WASDE) was released on Monday 12 May pointing to higher corn and lower soy stocks in the US, and lower corn, but higher soybean stocks globally.

US corn yield estimate 181 bu/acre, soybeans 52.5 bu/acre.

China’s phosphate exports

China’s return to the phosphate market appears to be on the cards and traders have offered Chinese DAP in Ethiopia’s 13 May tender. The allocation details for exports are still unclear.

A meeting between China Phosphate and Compound Fertilizer Industry Association (CPFIA) and phosphate producers finished 14 May, attended by one representative from each producer. Export quotas were allocated separately to each company. Each producer’s export allocation remains confidential at this point.

CRU understands there will be an FOB price floor for DAP/MAP exports and a price ceiling for domestic EXW that will be set up in the coming days. Exports from May through September are understood to have been discussed, although the export quantity is expected to be higher than same time last year.

CRU’s estimate to date has been 1.3-2 Mt MAP + 2.8-4.5 Mt DAP. Overall, we expected an average 1.6 Mt MAP + 3.6 Mt DAP, but this is only a provisional estimate. Latest information now suggests a combined total of 4 Mt exports for DAP and MAP from May through September.

View from the sidelines

Simon Inglethorpe, editor of CRU’s Fertilizer International magazine, spoke to Antoine Hoxha, director general of Fertilizers Europe, on the conference sidelines. They discussed the Carbon Border Adjustment Mechanism (CBAM) and the EU’s move to impose import tariffs on Russian and Belarusian fertilizers.

On CBAM, Fertilizers Europe reiterated its belief in the policy and pointed out that, unlike other sectors such as steel, aluminium and cement, the fertilizer industry’s position has always been welcoming and constructive, saying: “Let’s do this.”

Still, the association is looking for a delay in the free allocation phase-out as the cost increases from the current trajectory could encourage circumvention (cheating), in Hoxha’s view.

The Commission was not receptive to this argument at present, he said. Hoxha was also concerned that under the policy, Europe will not export in future unless a solution was found on export pathways before the summer. The need for a solution was quite urgent, in his opinion.

On Russian/Belarusian import tariffs, Fertilizers Europe said that, while supporting free trade, it believes the tariffs are necessary to protect EU industry and food security. It is cautiously optimistic that the policy will happen. “We should know by the end of May,” Hoxha said.

There is a parliamentary vote on 15 May, followed by final plenary vote by parliament the following week. It is therefore all down to the European Parliament, in his view.

The European Council vote will not be an obstacle, Hoxha suggested, as it has already pre-approved the tariffs by a qualified majority. The three-year timetable for implementing the tariffs is still too slow, he said.

The pre-announcement of the policy also prompted a buying spree since the start of the year, Hoxha noted. However, Fertilizers Europe does not think the proposed tariff policy will be costly. This is because it will simply reroute trade and not affect the supply/demand balance. A study they have commissioned predicts it will increase urea prices by around $5-10/t.

Au revoir!

And after a frantic but fascinating and productive few days, the CRU team is escorted from the Cote d’Azur…

See you next year!

Reporting by Simon Inglethorpe, Carrie Whymark, Brendan Daly, Christine Gregory, Rachel Gould and Lewis Walters.