Sulphur 405 Mar-Apr 2023

31 March 2023

Market Outlook

SULPHUR

- Chinese domestic sulphur supply growth remains strong. Production is expected to rise in 2023, putting pressure on import demand potential. In 2022 total imports were 7.6 million tonnes, with a stable view for the year ahead.

- In the processed phosphates market, the consensus view is that exports from China will begin to normalise in April-May with restrictions eased and the domestic season ended, but there has been no official confirmation of this. The expected increase in Chinese supply and concern over the pricing of DAP is a bearish factor for the market.

- New sulphur supply is expected online in Oman with commissioning and testing of the Duqm refinery under way, ahead of the start of commercial operations at the end of the year. Sulphur capacity is expected to ramp up between 202425. The Middle East region will add over 1.6 million t/a of new capacity this year, leading to an uptick in export availability.

- Sulphur supply from Canada to offshore markets is expected to be supported by additional forming capacity with the expected start-up of the South Cheecham project in Alberta later this year.

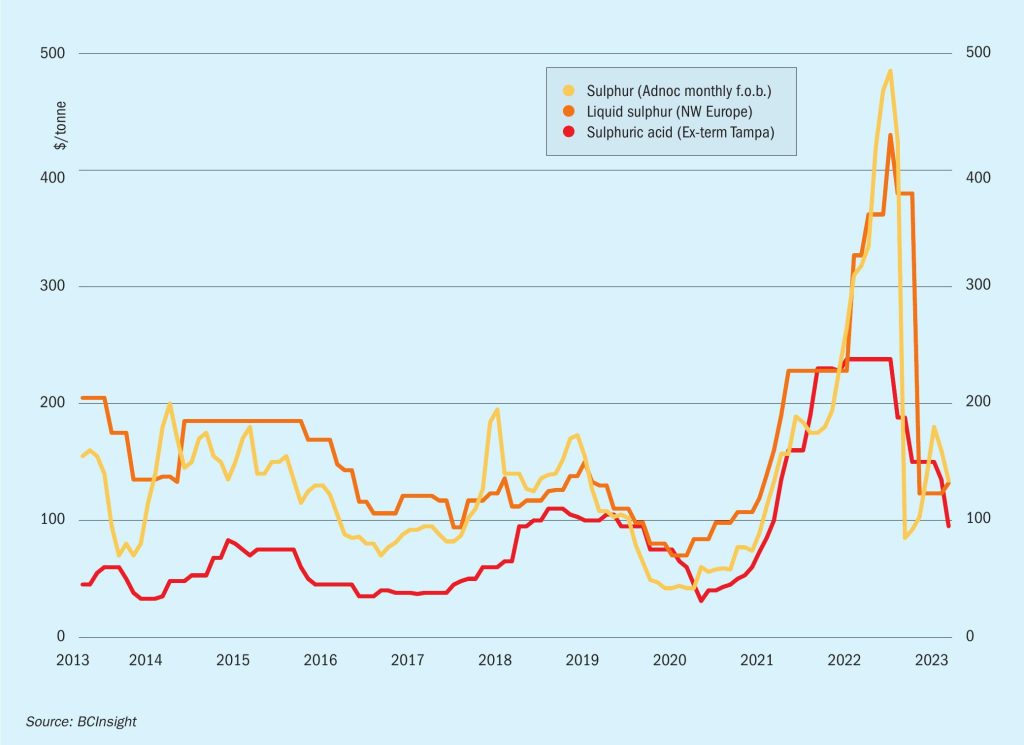

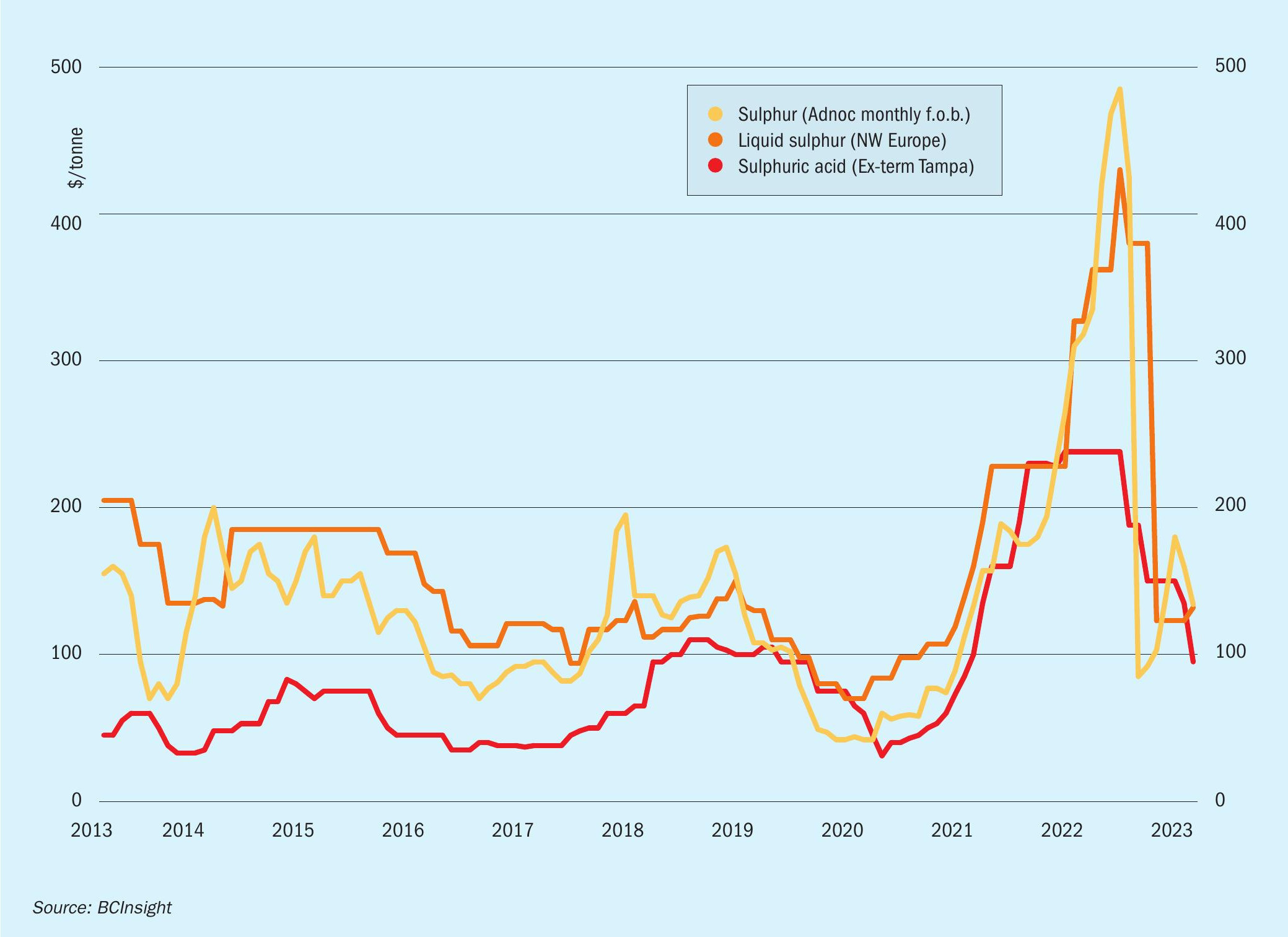

- Outlook: Prices are expected to continue to soften in the short term with limited spot demand emerging while second quarter contract negotiations are underway. The global market is expected to be broadly balanced later in the second quarter, with the potential for sulphur prices to recover in June if demand rises as expected.

SULPHURIC ACID

- High energy costs continue to impact some downstream sectors for acid. BASF has announced the permanent closure of its caprolactam plant and associated fertilizer facilities at its Ludwigshafen site in Germany. Energy costs added an additional pressure on margins and competitiveness.

- Indonesian nickel high pressure acid leach operations have been active in the acid spot market, a trend expected to continue for the short term. Halmahera Persada Lygend booked four cargoes for mid-late April shipment. Tsingshan also booked volumes for April-May delivery.

- Base metals prices declined in March with huge uncertainty in financial markets caused by the failure of two US banks spooking investors. Efforts towards stabilization allayed anxiety slowing price drops on 16 March.

- Outlook: The price downturn is expected to turn to stability by the second quarter with incremental recovery expected. With sulphur prices stable to soft in the short term, this may encourage buyers to the acid market during this period. The rate and pace of Chinese smelter acid capacity additions will be a key influence for the short term outlook as well as the return of China to the processed phosphate export market.