Nitrogen+Syngas 366 Jul-Aug 2020

31 July 2020

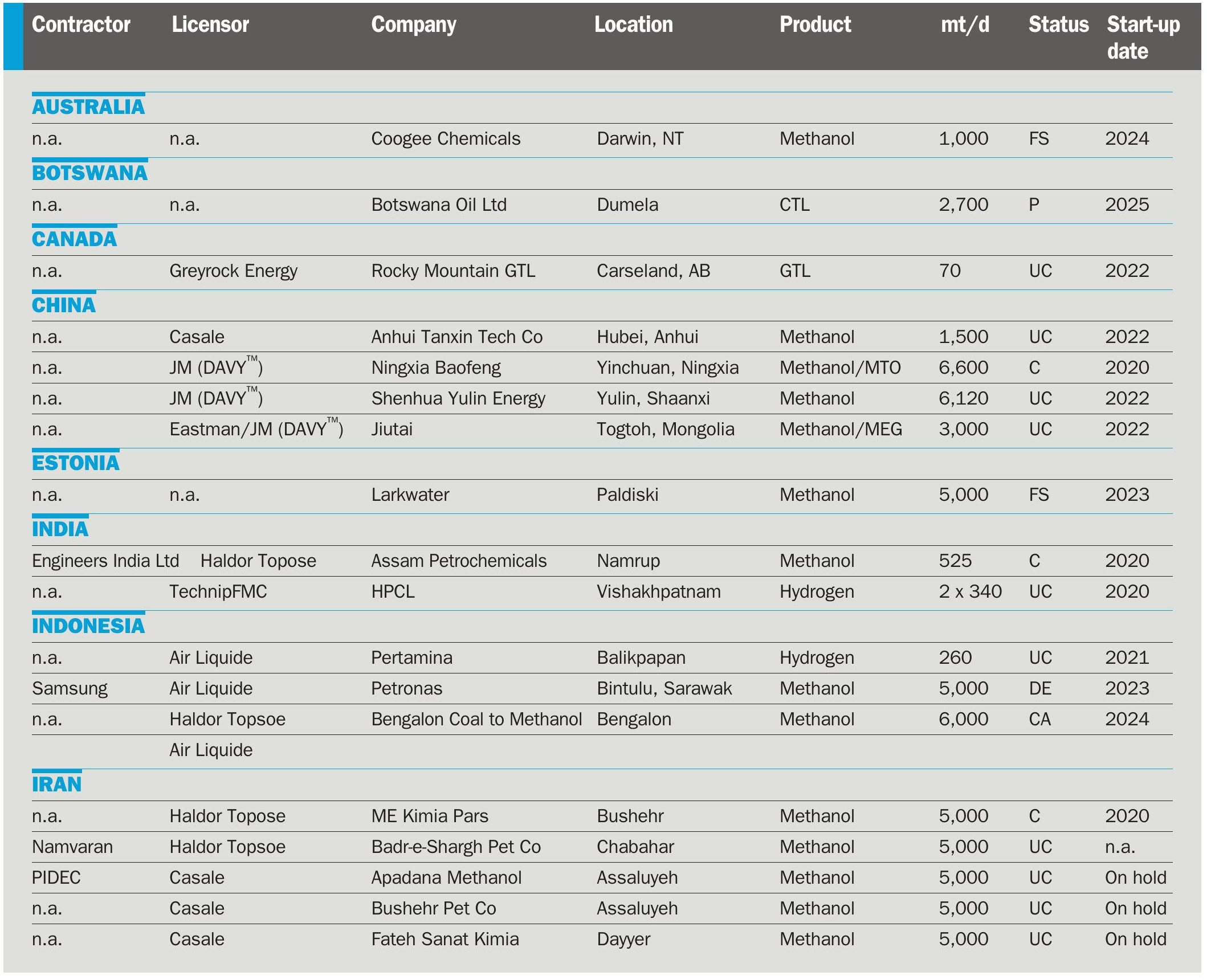

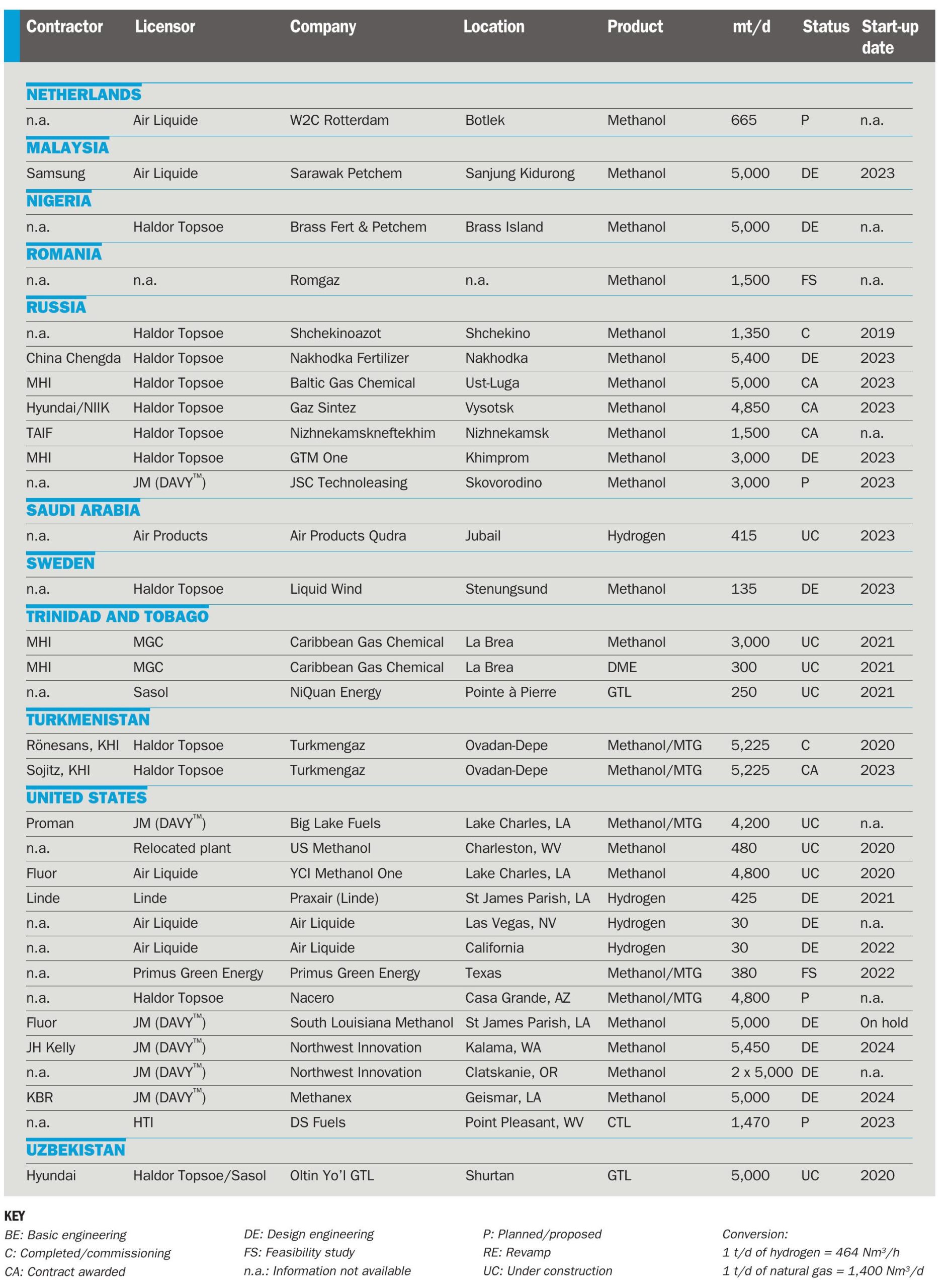

Syngas project listing 2020

PROJECT LISTING

Syngas project listing 2020

A round-up of current and proposed projects involving non-nitrogen synthesis gas derivatives, including methanol, hydrogen, synthetic/substitute natural gas (SNG) and gas- and coal to liquids (GTL/CTL) plants.