Argus Fertilizer Europe 2022

More than 650 delegates from 326 companies and 56 countries gathered at the Hotel RIU Plaza España, Madrid, Spain, 17-19 October 2022, for the Argus Fertilizer Europe 2022 conference.

More than 650 delegates from 326 companies and 56 countries gathered at the Hotel RIU Plaza España, Madrid, Spain, 17-19 October 2022, for the Argus Fertilizer Europe 2022 conference.

A record rise in gas prices at the end of August triggered a spate of ammonia production curtailments across Europe. These included major shutdown announcements from CF Fertilisers UK, Grupa Azoty, Yara International and others.

T he high-price environment for fertilizers and other commodities, including natural gas, is having very different consequences globally.

The Argus Fertilizer Europe Conference returns as an in-person event at the Hotel RIU Plaza España, Madrid, Spain, 17-19 October 2022.

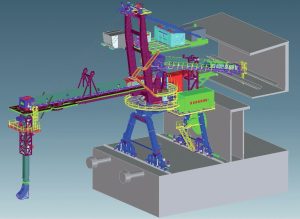

The refurbishment and modernisation of fertilizer plants offers the opportunity to reduce operating costs, raise production capacity, improve energy efficiency and cut emissions.

The phosphate fertilizer industry is turning to production methods that are able to consume low-grade phosphate rock and/ or generate pure gypsum as a by-product. Gypsum-free processes, and technologies that capture phosphorus from waste streams, are also on the rise.

Liquid fertilizers are emerging as a high growth, multibillion dollar market. Their growing use is linked to trends such as no-till farming and the greater adoption of precision agriculture. Leading producers and products are highlighted.

High feedstock prices and regulatory burdens continue to put pressure on European nitrogen producers to innovate.

Recent spikes in natural gas prices, particularly in Europe, have highlighted the tightness of natural gas markets around the world going into the northern hemisphere winter. Are ammonia and methanol producers on for a run of high gas prices in 2022?

Like the vital nitrogen fertilizer they handle, seasonal cheer will be in short supply for Europe’s ammonia producers and buyers this festive season, after many difficult months in which upward price trajectories showed no sign of slowing.