CF ships first low-carbon cargo to Europe

CF Industries has made its first shipment of certified low-carbon ammonia to Europe.

CF Industries has made its first shipment of certified low-carbon ammonia to Europe.

A summary of recent company appointments.

Ammonia producer CF Industries says that it has shipped its first cargo of low-carbon ammonia from its Donaldsonville, Louisiana facility. The 23,500 tonne shipment was purchased by commodities specialist Trafigura to be used in Antwerp, Belgium by engineering materials firm Envalior in the production of low-carbon caprolactam.

The carbon dioxide dehydration and compression unit at CF's production complex at Donaldsonville, Louisiana, is ready to start up.

CF Industries is planning to construct the world’s largest low-carbon ammonia plant in Louisiana as part of a joint venture (JV) with Jera and Mitsui.

CF Industries has formed a joint venture with JERA, Japan’s largest energy company, and Mitsui & Co, a leading global investment and trading company, for the construction, production and offtake of low-carbon ammonia.

We compare and contrast the 2024 financial performance of selected major fertilizer producers following the publication of fourth quarter results.

Venkat Pattabathula, a member of the AIChE Ammonia Safety Committee, reports on the American Institute of Chemical Engineers’ (AIChE) Safety in Ammonia Plants and Related Facilities Symposium held in San Diego on 8-12 September 2024.

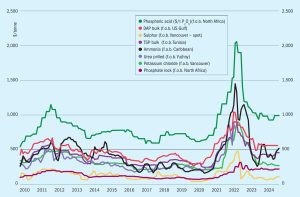

Market snapshot, 17th October 2024 Urea : Prices firmed in a thin market in mid-October. Middle East values shot up $20/t on expectations that Indian Potash Limited (IPL) would announce another tender to secure tonnes for India in December. If correct, this will follow hot on the heels of the latest Rashtriya Chemicals and Fertilizers (RCF) purchase tender for 0.56 million tonnes of urea. Sohar International Urea & Chemical Industries (SIUCI) sold a November cargo at $390/t f.o.b. with further trader interest reported at $385/t f.o.b. This demand was probably generated by traders positioning themselves for IPL’s expected tender, given that other markets generally remained quiet.

Mark Thompson became Nutrien’s executive vice president (EVP) and chief financial officer (CFO) on 26th August. Mr Thompson succeeds Pedro Farah , who will remain with the company in an advisory capacity until 31st December as part of a succession plan.