Fertilizer plant revamping: technology & projects

The refurbishment and modernisation of fertilizer plants offers the opportunity to reduce operating costs, raise production capacity, improve energy efficiency and cut emissions.

The refurbishment and modernisation of fertilizer plants offers the opportunity to reduce operating costs, raise production capacity, improve energy efficiency and cut emissions.

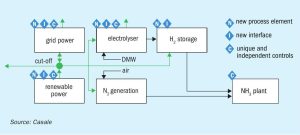

Economically viable production of green ammonia requires plants that can react to fluctuations in renewable power thanks to their flexible design. Casale’s Francesco Baratto, Giovanni Genova and Sergio Panza explain how new tools are helping design green ammonia plants that deliver the highest possible production at the lowest possible cost.

Certain fertilizer prices are likely to remain above $1,000/t well into 2023, according to Moody’s.

CRU’s Nitrogen + Syngas conference returned to a face to face meeting for the first time in two years at the end of March this year.

Casale has acquired Hong Kong-based Green Granulation Ltd (GGL), and its proprietary technologies for the design and construction of urea and calcium ammonium nitrate (CAN) granulation systems. Casale says that the takeover is part of a broader strategy aimed at strengthening its leading position in the nitrogen market by leveraging the widest integrated portfolio of efficient technologies, enabling the company to offer a ‘one stop shop’ for the entire production cycle of nitrogen-based fertilizers, from raw materials to final products. GGL’s addition to the Casale group includes the Cold Recycle Granulation process, an advanced fluidised bed technology designed to accept a lower concentration of urea feed melt (ca 96% urea and biuret), as well as a proprietary design for both granulator and scrubber, a team of experts and qualified technicians, and considerable experience in several industrial references. The CRG design has a horizontal layout, leading to lower structural costs and higher efficiency, as well as lower total investment costs and power consumption, lower power consumption and simplified operation, and higher operational flexibility in urea and CAN granulation.

The CRU Nitrogen + Syngas Conference returns to Berlin for a live event from 28-30 March 2022. The conference will be run as a hybrid event giving participants the option to attend live in-person or online via the virtual platform.

Switzerland-based EuroChem Group AG says it has entered into exclusive negotiations to acquire the nitrogen business of the Borealis group, after having submitted a binding offer. One of Europe’s leading fertilizer producers, Borealis operates fertilizer plants in Germany, Austria and France, as well as more than 50 distribution points across Europe. It supplies 3.9 million tonnes of fertilizer products per year, including 800,000 t/a of technical nitrogen solutions and 150,000 t/a of melamine via the Borealis LAT distribution network. It is a market leader in melamine, with its operations in Austria and Germany supplying primarily the woodworking industry. EuroChem says that melamine and technical nitrogen solutions represent important new business lines for the company to expand its nitrogen-based product portfolio in Europe.

High feedstock prices and regulatory burdens continue to put pressure on European nitrogen producers to innovate.

Improvements to equipment and materials are driving greater operational performance and higher efficiencies at urea plants. Recent advances are reviewed.

EuroChem has made a binding offer for Borealis Group’s fertilizer, melamine and technical nitrogen business.