Fertilizer International 529 Nov-Dec 2025

21 November 2025

Ukraine’s fertilizer market abides

COUNTRY REPORT

Ukraine’s fertilizer market abides

Having endured more than 40 months of conflict and crisis, Ukraine’s resilient fertilizer market has undergone an import-led revival following a calamitous collapse in consumption in 2022.

With the conflict with Russia now well into its fourth year, Ukraine’s fertilizer market is still beset with war-related disruptions. Imports into the country have surged, as domestic production capacity, constrained by power outages and war damage, has been unable to match rising demand.

Nonetheless, given the daunting daily challenges faced by Ukrainians and the war footing of its economy, it is the resilience of Ukrainian agriculture – and its persistence and ingenuity in successfully securing fertilizer supplies – that is perhaps most surprising. Ukraine’s fertilizer market continues to recover, showing resilience and adaptability under the most difficult conditions.

At the start of the conflict in 2022, fertilizer consumption in Ukraine fell dramatically. While some farmers had access to stocks accumulated during previous years, others were forced to stop using fertilizers completely for logistical and/or cost reasons. Since then, Ukrainian fertilizer supply has been radically reconfigured, as market participants have found new and creative ways of satisfying domestic fertilizer demand.

A vast and fertile steppe

Agriculture is a key pillar of Ukraine’s economy, being the third largest sector after services and industry. Prior to 2022, the sector generated more than 10% of GDP and employed 2.5 million people, some 14% of the country’s workforce.

Ukraine is the second-largest country in Europe after Russia. Before the current conflict, 41 million hectares (Mha) of land were devoted to agriculture, almost 70% of the country’s total area, with arable land contributing 33 million Mha to this total.

The country has long been called the breadbasket of Europe, thanks to its famously fertile black soil (chernozem) and vast tracts of arable land. Three export oriented crops – wheat, maize and sunflower – dominate the country’s agricultural output. Collectively, agricultural goods accounted for more than 40% of Ukrainian exports in 2021 with these generating $27 billion in foreign revenues.

Ukrainian control of arable land slipped to an estimated 27 Mha in 2024, down from 33 Mha previously, as a direct result of Russian incursions to the east. The country’s agricultural system also sustained $80 billion in war damages and losses, as of December 2023, according to a Kyiv School of Economics review. This total splits into revenue and asset losses of $70 billion and $10 billion, respectively.

The shock to agriculture and the economic hit to farmers from the first year of fighting was dramatic. This period saw a 30% contraction in Ukrainian grain and oilseed production, together with a dramatic 45% fall in farm gate prices for maize and wheat.

Import-led demand recovery

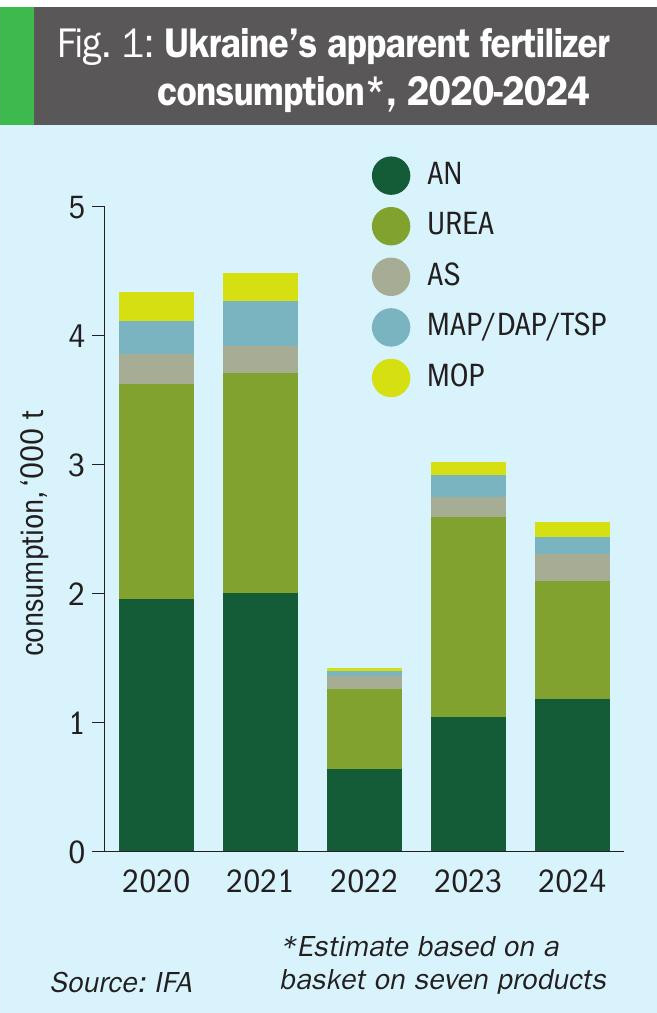

Having endured 10 months of conflict and crisis, Ukraine’s apparent fertilizer consumption plummeted by close to 70% year-on-year (y-o-y) in 2022 – down from 4.58 million tonnes in 2021 to 1.45 million tonnes – before partly recovering to 3.08 million tonnes in 2023 and then slipping back to 2.58 million tonnes last year. These figures are estimates, however, and may not represent the full picture, being based on a basket of seven products (Figure 1).

Ukraine’s fertilizer supply is heavily import dependent, with urea, ammonium nitrate (AN) and NP/NPKs among the main product preferences. Conflict-related disruption to domestic production plants has deepened import reliance, especially from suppliers in Lithuania, Turkey and Poland.

Since 2021, new but higher cost land routes have partly replaced shipping for import supply, as Oliver Watkins of Waypoint Commodities has noted:

“The ongoing conflict has severely impacted Ukraine’s logistics network, which is essential for both importing fertilisers and distributing them domestically. Major shipping routes through the Black Sea have been disrupted, making it difficult for Ukraine to access global markets and receive fertiliser supplies efficiently. Railway infrastructure, which has historically been a vital means of transporting agricultural inputs like fertilisers, has too faced intermittent blockages, further complicating the distribution network.

“Despite these issues, [Ukraine] … has made considerable efforts to adapt. Alternative routes via land through Poland and other neighbouring countries are being utilised, though at a higher cost.”

Ukrainian fertilizer importer GOL highlighted the following 2024 fertilizer imports trends in an end-of-year review:

• Imports last year rose by 14.5% y-o-y with notable increases for both nitrogen fertilizers (to 1,256,700 tonnes) and NPKs.

• Ammonium sulphate (AS) imports also reached a record 435,500 tonnes in 2024, with 182,600 tonnes arriving in the last the last two months of the year. More than 302,000 tonnes were imported from China, supplemented by European supply from Poland, Latvia, Belgium and Serbia. Domestic AS production, meanwhile, totalled 90,000 tonnes.

This import-led recovery in fertilizer use is set to continue in 2025. In September, agri-food data company Tridge reported that Ukrainian farmers have increased their fertilizer consumption by more than 20% in the year-to date – with this figure reflecting a surge in imports.

The country consumed 3.42 million tonnes of fertilizer in total during the first eight months of 2025, it said, quoting figures sourced from Infoindustry, the Ukrainian information agency.

Ukraine’s fertilizer imports reportedly reached almost two million tonnes during January-August 2025 (1,971,000 tonnes) – an increase of around 24% y-o-y – with nitrogen fertilizers predominating and accounting for 1.149 million tonnes (58%) of total imports over this period (Table 1).

Domestic fertilizer production in Ukraine, meanwhile, reached 1.450 million tonnes in the first eight months of 2025, according to Infoindustry data.

Domestic production decline

Although Ukraine operates significant nitrogen fertilizer production capacity, domestic output fell last year.

Major Ukrainian producer OSTCHEM, part of Group DF, produced 1.8 million tonnes of fertilizers from its two operative sites in 2024 – a 13% fall on the 2.1 million tonnes produced in 2023. Its Cherkasy Azot complex maintained its production level at 1.4 million tonnes, while the Rivneazot site saw its output volume decline by 22% y-o-y to 407,000 tonnes, versus the 528,000 tonnes produced the previous year.

On a product basis, OSTCHEM manufactured the following in 2024:

• Ammonium nitrate (AN) – 760,200 tonnes

• Urea ammonium nitrate (UAN) – 506,700 tonnes

• Urea – 401,900 tonnes

• Ammonia – 75,000 tonnes.

The company attributed last year’s production decline to low grain prices on global markets, power outages, the ongoing war, and the import of cheap, low-quality fertilizers.

Ukrainian farmers are going through difficult times due to falling profitability, said Sergiy Pavlyuchuk, OSTCHEM’s nitrogen production director, at the start of this year.

“This is reflected in domestic demand for mineral fertilizers – sometimes priority was given to cheaper, low-quality fertilizers imported in large quantities in 2024,” Pavlyuchuk said. “We take a long-term approach, and even in hard times, we have ensured the high international quality of our products and 100% fulfilment of obligations. Even during periods of forced shutdowns at Rivneazot due to power outages, these business values remained unchanged.”

OSTECHEM’s average capacity utilisation rate remained below 70% last year, with the company again citing the market entry of “uncontrolled imports” as being to blame.

More positively, the company launched a new UAN production line at Rivneazot in 2024. An investment project for the launch of urea production in 2025-2026 is also planned, Pavlyuchuk added.

“The key task for the year ahead [2025] is to ensure sustainable production despite unstable energy supply, reduce production risks, and displace imports through better quality,” Pavlyuchuk said in January, adding: “Our long-term strategic priority remains unchanged: import substitution and increasing market share. We will continue to invest in the production of the most in-demand fertilizers and expand our product line.”

In March, Ukraine’s cabinet approved the sale of the government’s stake (>99%) in the NP/NPK producer PJSC Sumykhimprom. The plan is to auction this stake at a starting price of UAH 1.158 billion ($27.4 million).

Sumykhimprom, which is located in the war-torn Sumy region of north eastern Ukraine, has previously manufactured ammonium sulphate, ammoniated superphosphate, Superagro NP (10:40/12:24) and a wide range of Superagro NPK formulations.

The company announced the resumption of fertilizer production in April of last year. Although the latest output figures and the plant’s current status are unavailable, Sumykhimprom is reported to have manufactured around 120,000 tonnes of fertilizers annually prior to 2022.

Logistical rerouting

The EU, together with Ukraine and Moldova launched the ‘EU-Ukraine Solidarity Lanes’ in May 2022, establishing new transport routes to keep Ukraine’s imports and exports flowing via rail, road and inland waterways. These have acted as a lifeline to the country’s economy and in January this year transported:

• Around 80% of Ukrainian imports (in comparison to around 20% through the Black Sea)

• Around 40% of Ukrainian exports of non-agricultural products (in comparison to around 60% through the Black Sea)

• Around 40% of Ukrainian exports of grain, oilseeds and related products (in comparison to around 60% through the Black Sea).

In total, around 180 million tonnes of Ukrainian grain, oilseeds and related products have been exported through the Solidarity Lanes (50%) and Black Sea ports (50%) during the period May 2022 to January 2025.

The new trading corridors have also played a crucial role in Ukrainian import supply. Over the same period, they have supplied around 70 million tonnes of goods, including fertilizers, as well as military and humanitarian assistance.

During the early stages of the conflict, with Black Sea ports blockaded, the Solidarity Lanes were Ukraine’s only export option for its agricultural produce. Grain shipments from Ukraine’s Black Sea ports did, however, restart in August 2022 under the UN-brokered Black Sea Grain Initiative (BSGI). This allowed the export of nearly 33 million tonnes of grains during its yearlong existence.

Subsequently, following Russia’s ending of its participation in the BSGI in July 2023, Ukraine launched a new Black Sea corridor for trade vessels heading to and from Ukrainian ports. The role of this ‘Ukrainian corridor’ has increased over time – helped by new insurance schemes for shipping – with monthly grain and oilseed exports of around three million tonnes in January 2025, for example.

Naval ban on ammonium nitrate

Ukraine did, however, face a fresh fertilizer supply headache in July, after the country’s navy imposed a ban on the import of ammonium nitrate via seaports due to safety fears. The resulting supply chain disruption could add 20% to fertilizer prices, according to Volodymyr Huz, commercial director of Ukrainian logistics company GOL.

“Now, when preparations for nitrate shipments should be underway ahead of the autumn season, alternative routes must be explored – including the Romanian ports of Galati and Braila. From there, cargoes can be transshipped and transported to Ukraine via broad-gauge wagons.

“However, this is an expensive option for Ukrainian importers, since nitrate is a basic fertilizer with minimal margins. As a result, any additional logistics cost significantly affects demand – this will lead to higher prices for all fertilizers, as nitrate is a fundamental component in their production,” Huz said in July.

In August, Ukraine’s biggest farming union UAC called on the government to lift the new maritime import ban, warning that grains crop yields could suffer due to supply shortages.

“The key factor here is the ban on imports into Ukraine via seaports not only of grade A ammonium nitrate, which is indeed an explosive substance, but also of other nitrogen fertilisers that are completely non-explosive,” the UAC said in a statement.

The farming union said that Ukraine was potentially facing a 30% reduction in the yields of key crops unless the problem was urgently resolved.

Similarly, the Association of International Freight Forwarders of Ukraine (AIFFU) has also called on the government and military to either lift or amend the import ban. It suggested using terminals at Reni, a port on the Danube, for “ammonia-based fertilizer” imports – with safety stipulations such as daytime unloading, direct transshipment without storage, and prompt vessel departure.

Sufficient fertilizers for 2025 planting?

Ukraine’s total agricultural crop area was set to exceed 23 million hectares (Mha) in 2025, according to the start-of-year forecast by the country’s Agrarian Policy and Food Ministry. Ukraine also had sufficient fertilizers and fuel for the 2025 sowing campaign, the ministry said in January.

According to data released by the Ministry of Economy in late October, 31.5 million tonnes of grains have been harvested by Ukraine this year from 7.2 Mha, around 65% of the growing area sown with these crops. The wheat, barley, peas, and rapeseed harvests have all been completed.

The breakdown is as follows:

• Wheat – 22.5 million tonnes harvested from an area of 5.0 Mha hectares

• Barley – 5.3 million tonnes harvested from an area of 1.3 Mha

• Corn – 2.1 million tonnes harvested from an area of 0.4 Mha

• Peas – 0.6 million tonnes harvested from an area of 0.3 Mha

• Other grains and legumes – 0.9 million tonnes harvested from an area of 0.3 Mha.

Reports suggest that weather has caused more damage to Ukraine’s harvest this year than the conflict with Russia, especially in the southeast of the country.