Africa

18 February 2026

Yara’s 2025 earnings up 46% to $2.75bn

Written by Natalie Noor-Drugan

Data: Company reports

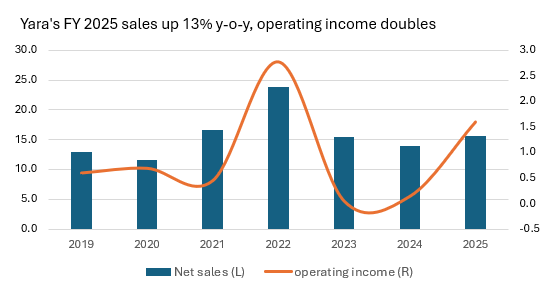

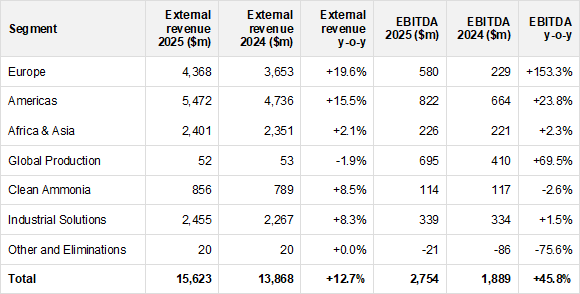

Yara International’s full-year earnings (EBITDA) surged in 2025, rising 46% year-on-year (y-o-y) to $2.75bn, while sales climbed 13% to $15.7bn and operating income more than doubled to $1.57bn. EBITDA excluding special items rose to $709mn in Q4 2025, up from from $519mn in Q4 2024, driven by stronger nitrogen margins, lower fixed costs and solid volumes.

Yara attributed the rebound in annual earnings to higher margins and volumes, alongside aggressive cost control, saying it has delivered more than $200mn of fixed-cost reductions since Q2 2024.

The earnings recovery was led regionally by Europe and the Americas, while Yara’s Global Production unit also posted a sharp y-o-y EBITDA increase. Commenting on the results, CEO Svein Tore Holsether said the 2025 earnings increase was “driven by higher nitrogen upgrading margins, lower fixed cost and strong volumes”, adding that Yara had “more than delivered” its savings plan.

Data: Company reports

Volumes: deliveries up, led by Europe and Brazil

Total deliveries increased to 32.1 million tonnes, up from 31.2 million tonnes a year earlier (up about 3%). Yara said the full-year increase was driven by Europe and Brazil.

By major product lines, 2025 deliveries increased year-on-year for urea (5,275 kt vs 5,193 kt; +1.6%), nitrates (4,877 kt vs 4,776 kt; +2.1%), NPK (8,411 kt vs 8,027 kt; +4.8%), and CN (1,698 kt vs 1,574 kt; +7.9%). NPK growth included higher Yara-produced compounds (6,201 kt vs 5,896 kt; +5.2%), while deliveries of DAP/MAP/SSP declined (352 kt vs 452 kt; -22.1%).

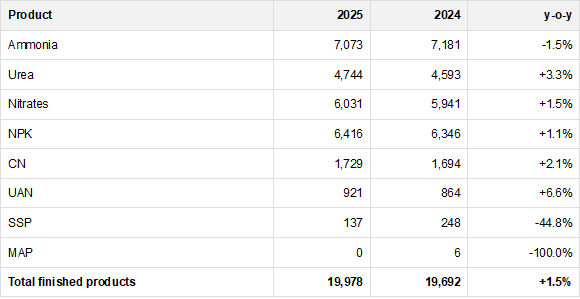

Production increases overall

Yara’s 2025 ammonia production was down marginally y-o-y at 7.1 million tonnes, while total finished product volumes were up slightly at 20.0 million tonnes. This was despite a 45% y-o-y fall in single superphosphate (SSP) production.

Data: Company reports

Restructuring

Yara highlighted limited restructuring to simplify its operating model and sharpen segment focus. This took place in in Q3 2025 and included the transfer of Pilbara ammonia plant from the Africa & Asia segment to Global Production, as well as the transfer of the joint operation of Pilbara Nitrates from Africa & Asia to Industrial Solutions.

Ammonia projects with Air Products

Yara named energy diversification and the mitigation of carbon costs as priorities. These included “maturing the ammonia projects with Air Products” with an estimated final investment decision (FID) in mid-2026. Yara is currently pursuing two ammonia projects with Air Products:

- At NEOM in Saudi Arabia (Oxagon), Yara would primarily act as a marketer and distributor, selling renewable ammonia through its network for a commission rather than taking ownership risk.

- For Daro (Darrow), Louisiana, US, Yara said it is working on a structure under which it would acquire the ammonia production assets once they are built and meet agreed performance levels, securing longer-term low-emission supply into its system.